Purpose of this article: to share a contrarian investment approach with consistent results that speak for themselves.

Bullet Point Summary

- The Golden Butterfly Portfolio is built as an extension of the Permanent Portfolio

- The Permanent Portfolio selects assets that perform in four distinct economic realities:

- Choose stocks to capture returns during economic Prosperity

- Choose cash & short-term treasuries to capture returns during economic Recession

- Choose gold to capture returns during periods of economic Inflation

- Choose long-term treasuries to capture returns during periods of economic Deflation

- The Golden Butterfly Portfolio is more aggressive than the Permanent Portfolio with a higher allocation placed in stocks.

- This portfolio protects you and grows your money regardless of what happens in the general global economy and it may be perfect for the “set it and forget it” investor.

Overview

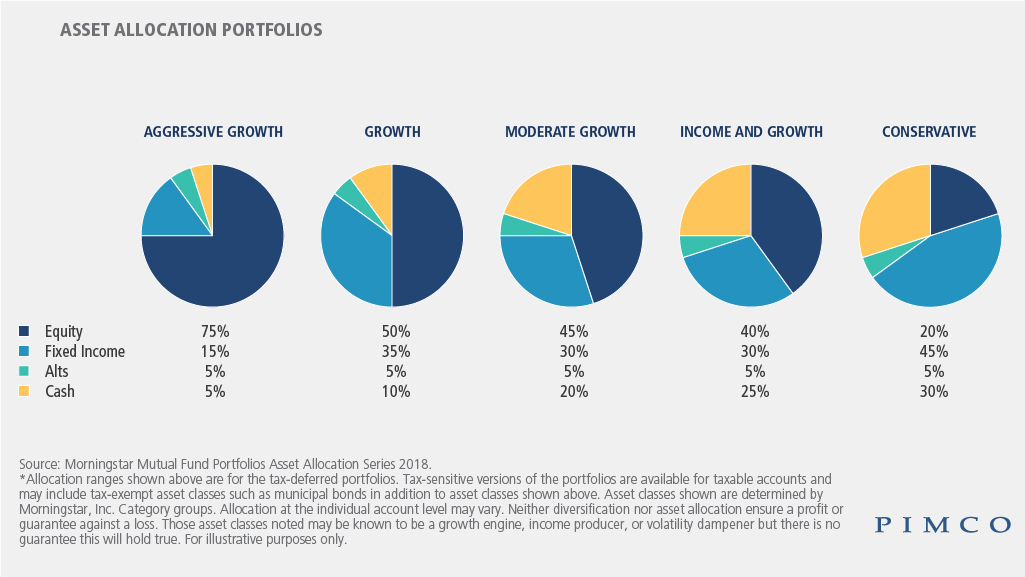

Whether you are a seasoned investor or new to investing, choosing the way you divide your investment up can be a daunting task. Google the word “asset allocation” and you will get over 164 million results. As shown in the following graphic from PIMCO Investment Management, there are five traditional methods to allocate your investments across different assets:

Building the right portfolio to capture long-term returns can feel like an endless exercise in futility. Some of us go at this alone, while others of us leverage money managers and investment advisors. Regardless of the approach, we all hope to end up with enough investment returns to retire comfortably. My hope with this article is to offer you a new and simple asset allocation that helps you set your investments and forget them until retirement.

What Is The Golden Butterfly Portfolio?

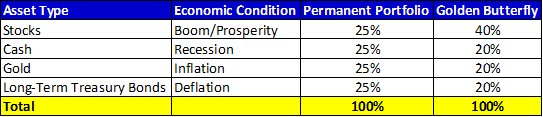

In 1998, Harry Browne wrote Fail-Safe Investing where he spelled out his principles for the “Permanent Portfolio.” The underlying thesis to his approach was that four economic conditions have historically occurred at varying frequencies throughout the years. By allocating investments in equal weights across stocks, bonds, cash, and gold, Browne theorized that his Permanent Portfolio would perform well regardless of the changing economic conditions.

The Golden Butterfly is essentially a more aggressive version of Browne’s Permanent Portfolio. Under the Golden Butterfly Portfolio, the exposure to stocks is increased from 25% to 40% while the exposure to Treasury bonds, cash, and gold are reduced from 25% to 20% respectively. The following chart details the differences between the Permanent Portfolio and the Golden Butterfly Portfolio:

By allocating your investments this way, you can take a more neutral outlook on a given economic condition. This investment approach grows your money no matter way the future holds.

How Does The Golden Butterfly Portfolio Stack Up Over Time?

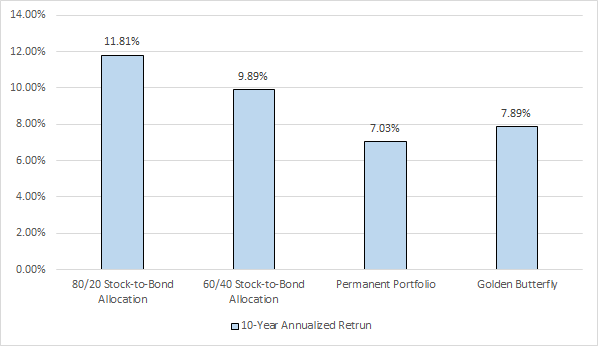

The following performance comparison is through September 30, 2020:

As you can see from the above, the clear winner has been the 80/20 stock-to-bond allocation which returned +11.81% over the last 10 years. But it is important to note that over the past 10 years, the economic conditions have been categorically Boom/Prosperity and the stock market has been on an unprecedented run. Thus portfolios with more exposure to stocks have done better over the past 10 years, than portfolios with less exposure to stocks.

Both the 80/20 stock-to-bond allocation and the 60/40 stock-to-bond allocations have more stock exposure than the Permanent Portfolio (only has 25% stock exposure) and the Golden Butterfly Portfolio (only has 40% stock exposure). And as such, they have performed better overall than both of those portfolios. It’s important to note though that investing in stocks carries more risk than investing in bonds or gold.

By investing in the Golden Butterfly Portfolio, you are giving yourself a chance to grow your money as seen in the +7.89% over the past 10 years. And you are doing so in a less risky fashion since only 40% of your portfolio is exposed to stocks. The downside though is in Boom/Prosperity economic conditions, the Golden Butterfly Portfolio underperforms other portfolios with more stock exposure as shown in the graph above.

What is Right for You?

As I mentioned in the beginning of this write up building the right portfolio to capture long-term returns can feel like an endless exercise in futility. But only if you lose site of what you are trying to accomplish. Investors that are interested in setting a portfolio that grows their money while mitigating overall risk will be very interested in the Golden Butterfly portfolio.

While this portfolio sacrifices a lot of the upside of other more aggressive portfolios, it’s simplicity for the average investor or beginning investor outweighs this fact. You should heavily consider investing in the Golden Butterfly Portfolio if you are looking for an asset allocation that is simple and effective at growing your money over the long-term while allowing you to not worry about specific economic conditions.

The Extras…

- Here is video on how exactly you can build the Golden Butterfly using index funds.

- Awesome detailed write up of the Theory Behind The Golden Butterfly.

- Here are the different index funds that you can buy to create the Golden Butterfly Portfolio Asset Allocation:

| Investment Vehicle | Ticker | Category/Sector | Economic Condition | Weight |

| iShares 1-3 Year Treasury Bond ETF | SHY | Government Bonds | Recession | 20% |

| iShares 20+ Year Treasury Bond ETF | TLT | Government Bonds | Deflation | 20% |

| SPDR Gold Trust | GLD | Precious Metals | Inflation | 20% |

| Vanguard Total Stock Market ETF | VTI | Large Cap Growth Equities | Boom/Prosperity | 20% |

| iShares S&P SmallCap 600 Value ETF | IJS | Small Cap Value Equities | Boom/Prosperity | 20% |

| Total | 100% |

- More information on the 80/20 Stock-to-Bond Allocation

- More information on the 60/40 Stock-to-Bond Allocation

- More information on the Permanent Portfolio