Introduction

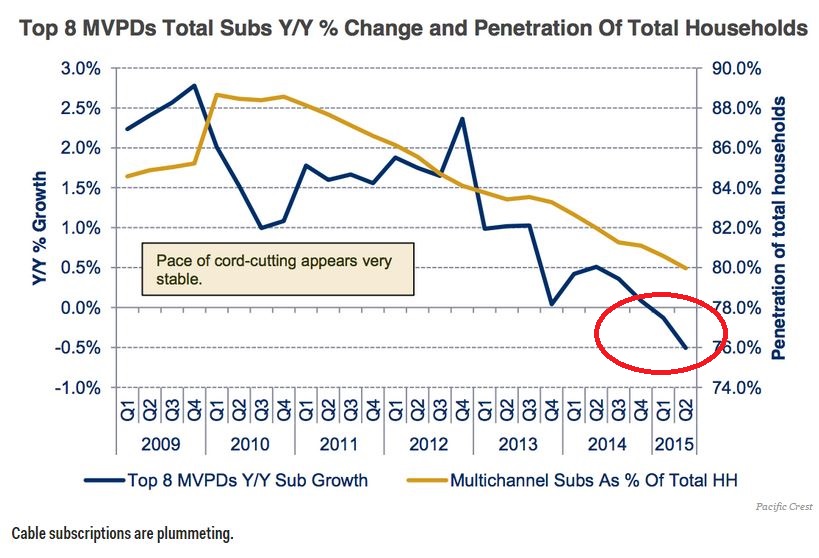

For the last five years, the percentage of households with cable subscriptions has been falling, and while cable television providers have known this, year-over-year growth has still been marginally positive. That was until 2015! For the first time in the history of cable subscriptions, year-over-year growth for the first half of 2015 trended negative[1].

The fact is traditional television viewing is unraveling, and big media conglomerates and their broadcast partners aren’t reacting quickly enough to changing consumer habits.

Thanks to Netflix, Hulu, and Amazon Instant Video, consumers are watching more television content online, and on platforms that do not rely on having a cable subscription.

But in the face of declining subscribers to cable television, ESPN has defied logic yet again and invested $7.3 billion for the exclusive rights to broadcast the college football playoffs through 2025. This move coupled with ESPN’s utter dominance of sports content only serves to prove that even in the face of growing demand by sports fans for non-cable sports options, we sports fans aren’t any closer to being able to completely cut the cord.

How does the current system work?

The ESPN sports television ecosystem works as follows:

-

- ESPN first secures compelling sports content preferably with exclusive broadcast rights by paying billions of dollars (i.e. $7.3 billion for the exclusive rights to the college football playoff)

- ESPN then convinces cable and satellite providers (The Comcast’s and DIRECTV’s of the world) that to carry ESPN in their cable packages.

- Cable and satellite providers shell out hefty monthly subscription fees for the “privilege” to carry ESPN and its network of channels[2]. ESPN costs $5.54 per subscriber per month while ESPN2 costs $0.70 per subscriber per month. ESPN News, ESPN Classic, ESPNU, and ESPN Deportes costs $0.20 per subscriber per month each

- Ultimately us sports fans are on the hook monthly for this expensive content through our monthly cable subscription bill. This is why most cable providers include ESPN in their premier or top tier cable packages.

At roughly 93 million pay-television subscribers[3], ESPN alone is pulling in a cool $6.18 billion yearly on just television subscriptions fees that it charges the cable and satellite providers. If you add in the fees it charges for its complete package (i.e. ESPN2 all the way to ESPN Deportes) and assume that a third of the subscriber base gets these channels (i.e. 31 million) total fees annually for ESPN total sports network jumps up to $6.73 billion!

As a point of comparison CNN and Fox News make $0.45 and $0.30 per subscriber per month. Using the same pay-television subscriber base as ESPN, CNN and Fox News make a combined $836 million annually. Put another way, ESPN stand-alone makes +639% more than CNN and Fox News combined! With the current system, ESPN can practically cover the cost of their college football investment in just one year!

ESPN doesn’t stop at just subscription fees. Since it has exclusive rights to broadcast certain sporting events from Monday Night Football back to the College Football Playoffs, ESPN makes a boat load of money charging companies to air advertising spots during commercial breaks of games. This past college football playoff alone, ESPN charged $1.0 million per 30 seconds, and in 2014, ESPN made approximately $3.9 billion in ad revenues which was a +63% year over year growth.

Between growing subscription fees and advertising revenue, ESPN makes a ton of money in the current system and its primary motivation is to protect the pay-for-TV profits. There is zero incentive over the next decade for them to change this model … or is there?

Is ESPN actually in trouble of losing out in the digital age?

Estimates have stated that 94% of programming on sports channels is consumed live compared to 70% on network television[4]. To put this simply, there just aren’t too many truly live events that don’t allow you to skip ads. So what in the world would make them consider changing the model? The short answers lies in the simple fact that even in the face of ESPN’s dominance over live sports, fans are still walking away.

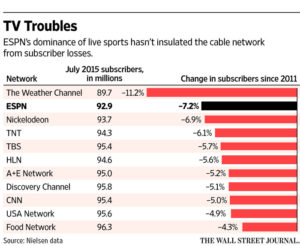

Earlier this year, Disney reported that it was trimming its forecast for TV subscriber-fee profit growth through next year because of subscriber losses at its flagship ESPN sports network[5]. Since 2011, ESPN has lost -7.2% of its user base, second only to the Weather Channel. Using the assumption that cord cutting is going to continue its acceleration over the next decade, ESPN could be looking at a subscriber base in 2025 of roughly 72.8 million, down -21.6% from its 2015 high of 92.9 million. By 2025 given these rates of falling subscribers, ESPN’s subscription fee revenue in 2025 would stand at only $4.84 billion, down from its 2015 high of $6.18 billion. Needless to say, if ESPN continues to stay the course it is in danger of losing large sums of revenue. But more importantly as the other media juggernauts have all experience over the past 10 years it’s only a matter of time before some digital start up comes in to eat your lunch.

Enter ESPN partnership with Sling TV

Through Sling TV (owned by Dish Network) and $20 a month users can get online streaming access to ESPN and ESPN2. An additional $5 a month gets you access to the Sports Extra package which includes ESPNU, SEC Network, ESPN News and a bunch of other peripheral ESPN channels.

Sling TV is perfect for the college football cord cutter! This package is more than sufficient to ensure that you will get all the games you need, and it’s much cheaper than the average $95.73 that cable and satellite companies typically charge[6]. If you happen to be like me and care about watching other sporting events like the Barclay’s Premier League or out of market NFL games, you’re still stuck in the current environment with a satellite or cable provider. This lack of consistent sport programming across all sporting events is often the most cited reason why consumers stick with traditional cable subscriptions.

Given ESPN’s $7.3 billion investment in college football, its partnership with Sling TV is a step in the right direction. But it’s still not enough to completely force ESPN’s hand or other sports broadcasters to drive into stand along stream services. So at best, if you take to heart what Disney CEO Bob Iger recently said, standalone sports services wont’s roll out for another five years (insert sad face).

[1]UDLAND, MYLES. “This is the scariest chart in the history of cable TV” Business Insider. 18 Aug. 2015. Web Retrieved 25 Aug. 2015

[2] BADENHAUSEN, KURT. “The Value of ESPN Surpasses $50 Billion.” Forbes Business. 29 Apr. 2014. Web Retrieved 14 Sep. 2015