Purpose of this article: to explain the importance of getting a term life insurance policy as soon as possible, especially if you have a spouse, partner, or dependent child (children).

Bullet Point Summary

- We recommend a term life policy over all other types of life insurance policies.

- Term life insurance policies provide death benefits to the policyholder’s beneficiaries if that person dies within the specified term of the policy.

- Terms are usually set at 10, 20, or 30 years and the term you choose is specific to your needs and expectations.

- General rule of thumb in deciding the amount of policy to take out: Take your annual salary, and multiply by 5 or 10 times.

- If anyone in your life is financial dependent upon you and your income, term life is an absolute must have.

Overview

There are many types of life insurance policies that provide a variety of benefits to the policyholder’s beneficiaries, but our recommendation is that you consider a term life insurance policy over all the others.

Term life insurance policies are better than the rest for a few specific reasons:

- The overall monthly premium (rate) usually costs less than the other types of life insurance options and once locked in, it will not change.

- The period of time for the policy’s life is set in very easy to understand terms (usually 10, 20, or 30 years).

- The policy can be cancelled at any time simply by not paying the monthly premium.

- It’s very easy to understand and very much straightforward especially compared to the other insurance products out there.

The rest of this article will help you better understand the nuances of term life insurance policies and get you comfortable with why we believe you need to get one as soon as possible.

What Exactly is a Term Life Insurance Policy?

A term life insurance policy provides a death benefit to the policyholder’s beneficiaries if that person dies within the specified term of the policy. The specified terms are typically set at 10, 20, or 30 years. This death benefit can be paid in one lump sum or in monthly installments.

The monthly premium (rate) for your policy is determined by actuaries and underwriters who use a variety of factors like your age, health, occupation, hobbies, and driving records to calculate the risk of insuring your life. Once risk is assessed, the monthly premium (rate) will be set by the insurance company based on this assessment, the specified term, and the size of the policy.

How Much Will Your Term Life Insurance Policy Cost?

A term life insurance policy is typically the cheapest way to purchase life insurance coverage. Rates will very based on length of the policy, amount of the policy, and overall health of the insured.

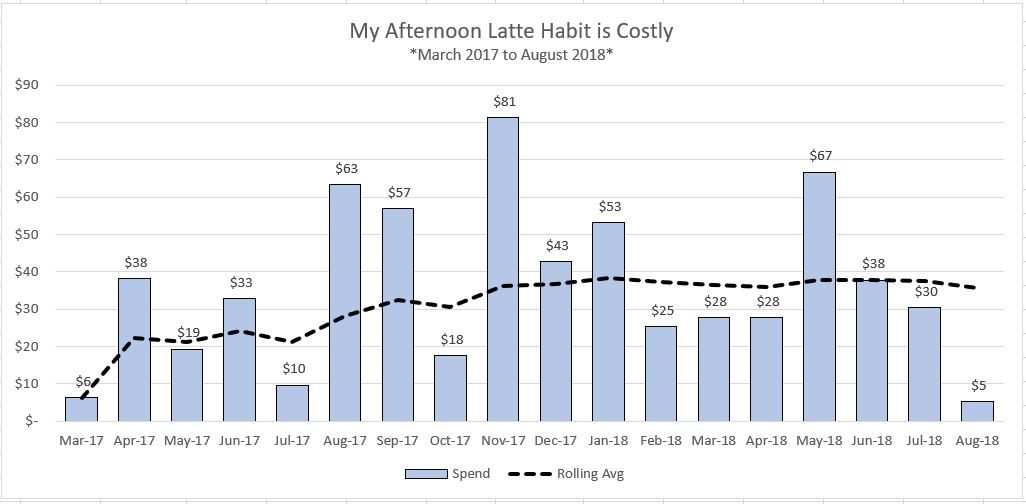

Using ValuePenguin the following are visual representations of monthly premiums for term life insurance at differing levels of health (Preferred Plus, Select, Standard) and differing levels of coverage ($250K, $500K, $1M).

$500K policy varies in monthly premium from a low of $22 to a high of $268

$1M policy varies in monthly premium from a low of $38 to a high of $508

You will notice that with term life insurance it can cost you as little as $15 a month to as much as $500+ a month depending on your age, health, term, and policy amount. In general, with term life insurance, it’s markedly cheaper the earlier you get it because a policy issued later in life has a greater likelihood of paying out. So, for your 20-somethings and 30-somethings reading this… GET YOUR POLICY TODAY!

What Amount Should I Choose?

Choosing the right term life insurance policy in terms of length and size is difficult because every single person’s situation is different. The amount you will need will depend on factors like your other sources of income, how many dependents you have, your debt levels, and in general your overall expectations on the lifestyle you want to live.

But with that said, you can apply the following general rule of thumb to find the starting baseline policy amount: Take your annual salary, and multiply by 5 or 10 times. The following chart details term life policy amounts based on annual salaries and the general rule of thumb:

What Term Should I Choose?

When you purchase term life insurance you will have to choose how long your coverage will last. Usually the terms are 10, 20, 30 but some insurance providers offer other terms. Based on our understanding of term life insurance policies and our work with some of our clients, the terms can be summarized as follows:

- 10-year policies are popular for those people who are on a very tight budget and probably won’t require insurance after their term expires. We usually recommend this for someone in their late 40s to early 50s.

- 20-year policies are the most popular, and are usually recommended for young families who often have large debt levels (school loans and mortgages) that would become troublesome if one of the breadwinners of the family happened to die unexpectedly. We usually recommend this for someone in their late 30s to early 40s.

- 30-year policies are awesome because your monthly premium will remain unchanged during the duration of that period even though your health will likely change during the same time period. Because you lock in your rate in your late 20s and early 30s when you are healthiest, your premiums will remain the same. We usually recommend this for someone in their late 20s to early 30s.

Closing

Suze Orman is quoted as saying, “if you want insurance, buy term; if you want an investment, buy an investment, not insurance. As we mentioned in the beginning, there are many types of life insurance policies out there, but at Blue Elephant Financial Services, the only one we recommend is a term life insurance policy.

If you have anyone in your life that is financial dependent upon you and your income, term life insurance is an absolute must have. It will secure their future against the loss of income that your death will bring. The only thing guaranteed in life is death and taxes. Use term life insurance to plan for one of the two!

My hope in writing this article is that after reading this, you will feel more comfortable with term life insurance thus making it much easier for you to take the necessary steps to acquire your own policy.