“The Bowl Championship Series (BCS) was devised outside the structure of the NCAA. It was a creation not just of the big six leagues but of the free market, of television. Since television made the BCS possible, television will ultimately have the final say on whether a larger and more inclusive BCS will work financially.”

-Keith Dunnavant, The Fifty-Year Seduction

Introduction

The Bowl Championship Series (BCS) is currently at a crossroads. On one hand, the BCS faces increased pressure and threats from anti-trust lawsuits which claim that access to the BCS is not uniform for all schools, especially non-BCS football schools. Although this imbalance between BCS schools and non-BCS schools is tough to deny especially when you consider that over the last 14 years of this system, 96% of all bowl revenue has gone to BCS conference schools, the 15 years preceding the creation of the BCS were no different[1]. During this time period, there were 120 selections made for the four top-tier bowls and only once did a non-BCS school participate.

On the other hand, college football’s postseason continues to show signs of declining popularity amongst football fans, especially outside of the National Championship game which will continue to threaten the financial viability of the entire system. While 2011 regular season games like LSU vs. Alabama (Nielsen rating of 11.5), Oklahoma vs. Florida State (Nielsen rating of 8.56), and Stanford vs. USC (Nielsen rating of 6.72) continue to show the trends of ever-increasing levels of fan viewership during the regular season, television ratings from some of the biggest postseason games continue to remain mediocre and downright disappointing. Examination of the Nielsen ratings for the four 2011-12 season BCS bowl games and the national championship further prove this point:

Exhibit 1. Nielsen Ratings for 2011-12 BCS Bowl Games

|

Bowl Game

|

Matchup

|

Nielsen

Rating

|

Change from

2011

|

|

Orange Bowl

|

Clemson vs. West Virginia

|

4.56

|

↓ 32%

|

|

Sugar Bowl

|

Michigan vs. Virginia Tech

|

6.07

|

↓ 18%

|

|

Fiesta Bowl

|

Stanford vs. Oklahoma State[2]

|

9.60

|

↑ 56%

|

|

Rose Bowl

|

Wisconsin vs. Oregon

|

10.17

|

↓ 10%

|

|

BCS Title Game

|

Alabama vs. LSU

|

14.01

|

↓ 8%

|

Contrary to all the rhetoric spread by BCS supporters, college football’s postseason is actually getting less popular as the years go on. In fact, college football’s average 2011-12 bowl rating dropped below 2007 levels for the lowest average Nielsen rating since the controversial BCS began[3]. Furthermore, overall viewership in 2011 was down eight percent from 2010. And since the inception of the BCS, total viewership has actually dropped a total of 37 percent3. To further complicate matters for college football, the NFL’s postseason continues to outperform college football on a head-to-head basis. The Nielsen ratings for the 2011 NFL postseason ratings are as follows:

Exhibit 2. Nielsen Ratings for 2011 NFL Postseason

|

Playoff Game

|

Matchup

|

Nielsen

Rating

|

Change from

|

|

Fox Super Bowl XLV

|

Pittsburgh vs. Green Bay

|

37.7

|

↑ 3%

|

|

NFL Championship

|

Green Bay vs. Chicago

|

17.6

|

↓ 11%

|

|

AFC Championship

|

Pittsburgh vs. New York Jets

|

18.6

|

↑ 16%

|

|

AFC Divisional

|

New York Jets vs. New England

|

14.8

|

↑ 21%

|

|

NFC Wildcard

|

Green Bay vs. Philadelphia

|

13.3

|

↑ 13%

|

The current BCS postseason format simply doesn’t stack up to the NFL or even March Madness, and its television ratings are a direct indictment on the current system’s inability to consistently deliver compelling matchups across all facets of the postseason[5]. Left alone, the BCS runs the risk of having television executives finally decide to sell (show) something other than subpar football match ups. The time for a new postseason product is now. Significant modifications to the current BCS are necessary for the long-term financial viability and popularity of college football.

Overview of Paper

This paper will examine the financial implications of a variety of changes to the current college football regular season and postseason. It will then compare the projected financial impact of each of these changes with the financial performance of the current BCS. This paper will focus on finding solutions to the popularity issues that college football’s postseason faces and will stay away from discussions on the anti-trust and fairness issues faced by the BCS.

These proposed changes will significantly increase the popularity of college football’s postseason, which will drive increased viewership and television ratings. But more importantly, these changes will increase total revenue and profitability for college football without adversely impacting academics, making it a win-win for college administrators, television executives, and fans.

Revenue and Profitability of the Bowl Championship Series Bowl System

The current BCS bowl system, which is a consolidation of private business with no affiliation to the participating schools, generates revenue from four main sources: (1) Ticket sales revenue, (2) Title sponsorship revenue, (3) Advertising revenue, (4) Television right payouts.

(1) Ticket sales revenue is derived from payments received from fans or schools for admission to the bowl game. Typically, fans will purchase tickets directly through their participating school but they can also purchase tickets on secondary markets like StubHub! or FanTickets.com to name a few.

(2) Title sponsorship revenue is derived from payments received from a patron (usually a corporation or other type of businesses) of the bowl game that has provided money, goods, and services in exchange for the exclusive right to have the patron’s name appear prominently before the title of the event. For example, think Discover Orange Bowl, Tostitos Fiesta Bowl, or Allstate Sugar Bowl.

(3) Advertising revenue is derived from payments received from corporations or other types of businesses for the rights to advertise their products and services through commercials during the telecast of the bowl game.

(4) Television right payouts are lump sum payments received by the bowl game from television networks and syndicators for the rights to broadcast the bowl game.

For decades, ticket sales provided nearly 100 percent of the revenue generated by bowls games but through the years as college football popularity soared, television entered the picture. Corporate advertisers began to recognize the value in the large, demographically desirable audiences that were watching college football, and consequently the television networks began to pay increasingly generous rights fees to retain this valuable college football programing, and corporations began to increase their involvement within college football.

By the 1970s, television had surpassed ticket sales as the primary source of revenue for bowl games and it hasn’t looked back since[6]. And as bowl games continue to struggle to sell tickets in modern times, television’s share of overall bowl game revenue continues to surge, as the various networks and syndicators continue to pay inflated fees even for mediocre matchups with limited national appeal.

Since the 2005 postseason, the BCS bowl system has grown total profit & revenue for the participating schools at a CAGR of 5.68 percent, but this growth has been primarily driven by increasing television rights, title sponsorship, and advertising payouts[7]:

Exhibit 3. 2005 – 2011 Profit & Revenue from BCS Bowl Games and National Championship:

Although revenue growth has been steady each year since its inception, the BCS’s postseason product pales in comparison to the revenue generated by some of its nearest counterparts. For a sport as popular as college football (nearly one-quarter of the U.S. population or between 75 and 80 million people follow college football regularly[8]), this simply isn’t good enough.This past year alone, March Madness generated $771.4 million in television contract revenue for its month long postseason collegiate basketball tournament which on its own is approximately four times the size of total combined revenue generated by the BCS postseason[9]. And an analysis of the profitability of the NFL television deal for the 2011-12 season and postseason shows total revenue of $1.93 billion per year. Future estimated projections show that the NFL’s total television contract revenue will grow to $3.09 billion by 2022[10]. From a revenue standpoint, college football’s postseason does not stack up to the NFL or even March Madness in its current format. Significant money is being left on the table and the current BCS postseason format is the primary reason for this.

The Proposal

Given the multiple levers that can be pulled in college football, the following significant modifications to both the regular season and the postseason must be made to significantly impact fan popularity and drive increased profitability:

1. Downsize Division I Football Bowl Subdivision (FBS) to 64 full members

2. Realign the remaining members into five BCS conferences each with a championship game

3. Eight-team playoff based on five BCS conference champions and three at-large births

4. Reduce the total number of regular season games from 12 to 10

5. Preserve the tradition of the non-BCS bowl games

Downsize Division I Football Bowl Subdivision (FBS) and Realign Conferences

Currently, in order to qualify for inclusion within Division I FBS, the NCAA primarily requires that its institutions average annually at least 15,000 in actual or paid attendance for all home football contests once every two years[11]. Consequently, because of this lackadaisical standard there are currently 120 full members of Division I FBS, which is far too many when you examine fan base followings and concentration of revenue generation. A comparison of 2010 average attendance records by conference show that BCS conference schools far and away outperform the majority of non-BCS schools on the basis of this primary FBS membership requirement, and this trend continues year over year (see Exhibit 4 below):

Exhibit 4. 2010 Average Attendance by Conference or Independent Team:

In this modern era of big time college football, attendance and ticket revenue represent only modest portions of overall revenue generated by college football (approximately 22%)7. Television has become the engine that drives college football revenue and because of this fact, television should be utilized in the determination of Division I FBS membership not year over year average attendance.

Although different college football programs around the country play into each of the large television media markets in different ways one theme is consistent across all markets: BCS conference schools have significantly larger fan bases and followings across more regions of the U.S. than non-BCS football schools. Exhibit 5 shows the estimated total fans by conference across numerous U.S. television and media markets:

Exhibit 5. Estimated Total Fans by Conference across U.S. Television Markets as of 2011:

Because of this fact, more fans in their respective markets want to see more BCS schools on television than non-BCS conference schools, and because of this demand, television executives continue to cut large checks to the 6 main BCS conferences, Notre Dame, and Texas for the rights to broadcast their regular season games. More fan viewership of certain conferences across the various television markets translates to potential opportunities for advertising revenue from the television networks’ perspective which translates to windfalls for most BCS schools.

In 2012, the Big Ten, SEC, ACC, Pac-12, Big 12, Texas, and Notre Dame are all expected to have record years in terms of regular season television revenue. Total payouts to each of the aforementioned parties per year will be as follows[12]:

Exhibit 6. Television Revenue by Conference and Team

|

Conference/Team

|

Revenue per Year

|

Expiration Date of Deal

|

|

Pac-12

|

$250 million

|

2023-24 (Fox and ESPN)

|

|

Big Ten

|

$212 million

|

2015-16 (ABC-ESPN); 2031-32 (Big Ten Network)

|

|

SEC

|

$205 million

|

2023-24 (CBS)

|

|

ACC

|

$185 million

|

2023-24 (ABC-ESPN)

|

|

Big 12

|

$150 million

|

2015-16 (ABC-ESPN); 2024-25 (Fox)

|

|

Texas Longhorns

|

$15 million

|

2031-32 (Longhorn Network)

|

|

Notre Dame

|

$15 million

|

2015-16 (NBC)

|

But while Notre Dame, Texas and the five BCS conferences mentioned above are all enjoying record windfalls, the Big East is floundering and the Mountain West, Conference USA, Sun Belt, WAC, and MAC all make less than $27.4 million per year combined. It’s a sellers’ market for college football content, and television executives aren’t buying the Big East and non-BCS product. To make matters worse, a majority of non-BCS schools are far from financially self-sufficient. A majority of these non-BCS football playing schools are only capable of “surviving” due to the large payouts they receive from their BCS counterparts for non-conference regular season games. Without these large payouts, which can often reach as high as $1.5 million per game, most non-BCS schools would be unable to cover the rising costs of Division I FBS membership. And current NCAA rules require each Division I football playing school to support a minimum of 16 other sports programs. So in essence, BCS conference schools subsidize the very existence of non-BCS conference schools. The fact simply is that non-BCS schools cannot support themselves and the cost of doing business within Division I FBS will force them to drop down to Division I FCS. It’s simply a matter of economics!

Realign the Remaining 64 Members into Five BCS Conferences

Unfortunately for the Big East, the preliminary rounds of conference realignments during the summers of 2010 and 2011 have left this conference on shaky grounds. The current television deal with ESPN for $200 million ($33.3 million per year) ended at the conclusion of the 2011-12 season, and the deal with CBS for $54 million ($9 million per year) is scheduled to end at the conclusion of the 2012-13 season.

With a depleted roster of Division I FBS football schools and no true major football powerhouses left in the Big East, the new television deal will not be enough it to keep this conference from dissolving. And because of these factors, the Big East will not survive as a football conference and its bell-weather programs like Rutgers, UConn, Boise State, USF, Cincinnati, and Louisville will have to find other conferences to join if possible.

Based on this new TV-driven realignment and television market focus, Division I FBS conferences will be best suited if realigned as follows:

With the initial rounds of expansion during the summer of 2010 and 2011, the SEC, ACC, Pac-12, and Big Ten all made significant strides to expand their geographic footprint and stabilize, while the Big 12 made strides to remain relevant. Because these other four conferences already have conference championship games additional expansion may not add significant additional value for them. Especially given the fact that each of these conferences’ regular season television deals are already locked in for the foreseeable future.

Currently, the Big 12 is the one BCS conference that does not have a conference championship game since it only has ten members which means that it is missing out on the extra television revenue that this game generates. This past year, the SEC, ACC, Big Ten, and Pac-12 conference championship games generated roughly $15-20 million in additional revenue for their respective conferences on top of the other television revenue received for their regular season games. Consequently, in the post Big East world the Big 12 will be the aggressor making moves to acquire two top quality programs. Based upon an analysis of the best independents available, these two programs are Notre Dame and BYU.

Notre Dame has one of the more highly nationalized fan bases in college football with significant followings in four of the largest television markets for college football: Los Angeles, Chicago, New York, and Philadelphia. This national following has allowed Notre Dame to reap the benefits as they earn well over $15 million a year from their current television deal with NBC. Unfortunately, since their last contract extension in 2008 the Irish have gone 29-22 and there are serious rumors circulating that NBC is considering walking away from this franchise once the current deal is over at the end of the 2015-16 season. This is the perfect storm for the Big 12.

As a conference, they are one of the only BCS conferences that allow their members to negotiate independent television contracts and keep all revenue streams; similar to Texas and the Longhorn Network. Furthermore, the ESPN portion of the current Big 12’s television deal expires at the end of the 2015-16 season, which is the same season Notre Dame’s NBC deal expires. The Big 12 can work with ESPN to lure Notre Dame with the promise of its own network and steady conference revenues. Joining the Big 12 would significantly increase Notre Dame’s television revenue from its current level of $15 million to approximately $27.5 million[13]. And it would also allow Notre Dame to guarantee that they would not be left out of the national championship discussion.

With large fan base followings in Chicago, Philadelphia, New York, and Los Angeles, the addition of Notre Dame would give the Big 12 a truly diverse geographic footprint. Additionally, Notre Dame to the Big 12 would give this conference the first (Texas – $129 million), second (Notre Dame – $112 million), and tenth (Oklahoma – $87 million) most valuable college football teams[14]. The Big 12 would have significant leverage in re-negotiations with ESPN which could push their annual revenue from there new television deal well above the $60 million a year mark it is currently at12. Adding Notre Dame to the Big 12 would be a win-win for Notre Dame and the ten other members of the Big 12 conference.

The addition of BYU gives the Big 12 the necessary 12 full members to allow them to adopt a conference championship game. It also grants the conference significant access to the television markets in Utah and Southern California allowing them to directly compete with the Pac-12 for television viewership. With an estimated 710 thousand fans, and a rich tradition of success, BYU is the best non-BCS school available after Notre Dame. BYU would be a necessary addition for the Big 12 to compete with the other four BCS conferences.

The downsizing of Division I FBS and conference realignments will be driven solely by television markets. As such, conferences with larger geographic reach will continue to generate larger television rights payouts. As a result, its members will be able to meet the rising costs of Division I FBS membership. With 120 full members within Division I FBS college football is oversaturated with more than 56 mediocre to subpar teams that truly add limited value to the total bottom line of the sport and aren’t financially relevant on their own,

Realignment and reduction of the number of full members within Division I FBS college football from 120 to 64 is necessary for continued deliverance of a top quality product. Although, the short-term financial impact from this move is the loss of $27.4 million in television revenue due to the demotion of the 42 members of Conference USA, the Mountain West, the Sun Belt, the MAC, and the WAC to Division I Football Championship (FCS) and the loss of $42.3 in television revenue due to the demotion of the 12 members of the Big East Conference, this is a small price to pay for a much improved quality of college football product; a price that fan viewership and television executives demand.

Eight-Team Playoff: Five BCS Conference Champions and Three At-Large Bids

The stated mission of the BCS is to provide a championship game between the two best Division I FBS college football teams and ultimately avoid split national championships similar to those that used to occur under the old bowl system. But for a system that was created 14 years ago to solve this problem, arguments surrounding nine of its current national champions can be made. The following chart details the nine questionable matchups and champions that the current BCS has created over the past 14 years which have left college fans and teams at best unsettled; at worst angry:

Exhibit 8. Controversial BCS Champions

|

Season

|

National Title Controversy

|

|

2011

|

Undefeated SEC Champion LSU loses to one-loss Alabama in a rematch of their regular season contest. One-loss Big 12 Champion Oklahoma State is left on the outside looking in.

|

|

2009

|

Undefeated Big 12 Champion Texas loses to undefeated SEC Champion Alabama. Boise State, TCU, and Cincinnati, all unbeaten conference champions, are left on the outside looking in.

|

|

2008

|

One-loss Big 12 Champion Oklahoma loses to one-loss SEC Champion Florida. One-loss Texas is left on the outside looking in even though Texas beat Oklahoma in the regular season and ended with the same exact conference record.

|

|

2007

|

Two-loss Big Ten Champion Ohio State loses to two-loss SEC Champion LSU. Two-loss Pac-10 Champion USC and two-loss Georgia are both on the outside looking in.

|

|

2006

|

Undefeated Big Ten Champion Ohio State loses to one-loss SEC Champion Florida. One-loss Michigan is on the outside looking in as a potential rematch with Ohio State eventually goes begging.

|

|

2004

|

Undefeated Big 12 Champion Oklahoma loses to undefeated Pac-10 Champion USC. Undefeated SEC Champion Auburn is left on the outside looking in.

|

|

2003

|

One-loss Oklahoma loses to one-loss SEC Champion LSU after Oklahoma loses its conference championship game to Kansas State. One-loss Pac-10 Champion USC, AP #1, beats Michigan in the Rose Bowl resulting in the first ever BCS split national championship.

|

|

2001

|

One-loss Nebraska loses to undefeated Big East Champion Miami. One-loss Big 12 Champion Colorado who beat Nebraska in the final game of the regular season is on the outside looking in. One-loss Pac-10 Champion Oregon is also left on the outside looking in.

|

|

2000

|

One-loss ACC Champion Florida State loses to undefeated Big 12 Champion Oklahoma. One-loss Big East Champion Miami who beat Florida State in the regular season is left on the outside looking in. One-loss Pac-10 tri-Champion Washington, who beat Miami in the regular season is also left on the outside looking in

|

Controversy and the BCS national champion are nearly synonymous. This should be no surprise though since the top teams are currently determined by coaches who vote along political lines, Harris Poll electors with obvious regional biases, and computers whose influence is neutered by the restrictions the BCS places on them5. As was mentioned before, contrary to what BCS apologists believe, this controversy has actually made college football’s postseason far less popular amongst fans. The heart of the problem with the BCS is its consistent lack of a feeling of finality. Division I FBS’s national champion is rarely crowned based solely on on-the-field accomplishments. Politicking and campaigning have become so ingrained within this system that the chance at playing for a national championship has become nothing more than a popularity contest, where contestants win by climbing to the top of the bumbling Harris Poll, bogus coaches’ poll, and the downright corrupt computer rankings.

A bona fide college football playoff is necessary to accurately and fairly crown a national champion, and add that “feeling of finality” which college football’s postseason sorely lacks. It’s no surprise that every other sport in America, including college football in lower divisions, has figured this out. With the BCS subject to renegotiation in 2014, the time is now to finally fix this broken system and an eight-team playoff is a viable and financially lucrative solution.

The downsized five BCS conferences easily fit into an eight-team playoff postseason format where the five BCS conference champions get automatic bids to the playoff. The remaining three at-large playoff berths would be determined by a selection committee comprised of athletic directors and conference commissioners throughout Division I FBS similar to the NCAA basketball tournament selection process. Once the eight teams are selected, the selection committee would then reseed and rank each of the teams from one to eight based upon a variety of factors from the final BCS conference ranking, to strength of non-conference schedule, to wins-losses against conference opponents, to name a few. Using the 2011-12 BCS postseason matchups, a hypothetical eight-team playoff for the current year would look as follows:

Exhibit 9. 2012 BCS Postseason Matchups Conformed to an Eight-team Playoff:

This eight-team playoff would give teams an incentive for winning their conference through the automatic bid reward. At the same time it would still give all 64 teams an opportunity to still make the playoffs without winning their conference through the at large bid system, giving significant credence back to the regular season. Similar to current arguments within college basketball’s March Madness, there would definitely still be arguments over the final three at-large bids. But these arguments would be centered on which two-loss teams were left out, not which unbeaten or one-loss teams are currently left out as the nine aforementioned controversies discuss. The competition for the final three spots would make the final month of the regular season a “circus” of flurried action. The excitement and “feelings of fairness” that a college football playoff would create would directly translate into increased viewership which would ultimately translate into more money from television executives. It would also significantly increase the value of the conference championship game, thus earning each of the five BCS conferences more than the current average of $15-20 million.

In terms of location and logistics, the eight-team playoffs would take place in multiple locations. The first round games would be held at the four traditional BCS bowls during the Friday and Saturday of the third week in December. The second round games would be held at the location of the highest bidder during the Friday of the fourth week of December. The final game would be held on or around New Year’s Day at a location to be determined by a bid system similar to the NFL Super Bowl where the stadium with the highest bid wins, giving this new playoff system multiple monetization points. This four week playoff would be completed in precisely the same timeframe as the current bowl calendar. This proposed eight-team playoff would bring meaning back to September, add excitement to October, and turn November into a football palooza as teams fight for their chance to earn one of the three at-large bids5. But more importantly (as will be discussed below), this eight-team playoff system will create larger revenue streams that will significantly benefit all teams within Division I FBS.

Currently, under increased pressure from waning popularity amongst college football fans, television executives, and an expiring contract, the 11 commissioners of the BCS executive committee finally proposed a four-team pro-style playoff system on April 26, 2012. The initial proposal for the four-team playoff released from the executive meetings is as follows[15]:

· A four-team playoff, with the semifinals and final rotated among the existing BCS bowl games (Sugar, Fiesta, Orange, and Rose).

· Four teams, with the semifinals rotated among the existing BCS bowl games and the final held at a neutral site. The location would be determined in a bid process, much like the Super Bowl is awarded.

· A four-team playoff, with semifinals and final held at either the existing BCS bowl game sites or neutral sites, determined by a bid process.

· Removal of all automatic bids placing full selection power in the hands of the selection committee

Initial valuations of this four-team playoff show increased distributions to as much as $360 million for the two playoff games. A final proposal is expected to be completed an sent to the NCAA Presidential Oversight Committee by July 4, 201215.

In their 2010 book, Death to the BCS, Dan Wetzel, Josh Peter, and Jeff Passan estimated that a full blown 16-team playoff would net approximately $550 – $760 million in distributions a year (post $200 million reduction for bowl executive compensation). Given the overall popularity of playoffs in our country and the fact that nearly one-quarter of the U.S. population follows college football regularly, it is not unreasonable to expect an eight-team playoff to generate $455 – $560 million, which represents the median between the estimated values of the four and sixteen-team playoffs. This would represent a 2.50 to 3.08 times increase over the 2011 distribution of the current BCS of $182 million. Exhibit 10 shows the valuation of the playoff proposal:

Exhibit 10. Comparison of Distributions from Playoff Formats with Current BCS:

Although the valuation shown above is a relatively imprecise figure, the fact remains that the current BCS system will be rendered financially obsolete in the coming years. What remains clear is a playoff system can and will generate more distributions to the 64 BCS teams. Utilizing a modified playoff format, college football will be able to generate significantly larger sums of revenue; revenue that can be used to meet the ever increasing financial needs of the 64 athletic departments around the U.S. currently struggling to meet the demands for multiple sports programs. In comparing the current BCS to an eight-team playoff format, it’s really a no-brainer: the BCS loses this debate in terms of fairness, excitement, and overall profitability… every time!

Reduce Total Number of Regular Season Games from 12 to 10

In a system where rankings are largely based on popular opinion and dubious computers the current BCS forces teams to practically go unbeaten in order to have a chance to play for the national championship. Consequently, the BCS bowl system has gutted the regular season by rewarding teams for scheduling cupcake opponents in a blatant effort to either go undefeated or secure the six wins needed to guarantee bowl eligibility5.

From 1998-2003, the BCS ranking system included a strength of schedule component which in essence attempted to reward teams for playing tougher opponents in and out of conference. But since the removal of this incentive in 2004, top non-conference matchups between teams have significantly decreased. In fact, over the past two decades, the number of Top 20 non-conference matchups has decreased by half every 10 years, and Top 10 matchups have virtually disappeared, going from a height of seven in 1988 to just one in 2008 and 2011[16]. The fact simply is, almost everyone is trying to find the easy way to success – which, depending on the level of your program, could be bowl eligibility, a BCS bowl, or a national championship15.

Weak non-conference games also serve another more financially relevant purpose for BCS, non-BCS, and FCS schools. With three to four non-conference games per year to fill, a majority of the larger 64 BCS conference schools use these games as an opportunity to tune up for tougher games and generate millions from easily winnable home games. With stadiums in excess of 50,000 to 100,000 thousand, these 64 BCS teams prey on their fans loyalty and wallets, as they flock to a home game just to see their team beat anyone, even a hapless FCS opponent. On average teams like Texas, Michigan, and the rest of their big school counterparts generate two to five million in revenue per home game. Consequently, these games represent a good way for big school teams to earn a victory and fill their stadiums and luxury suites.

These so-called “guaranteed games” also allow lesser programs to earn large sums of money in exchange for a presumed loss. On average, non-BCS and FCS schools can earn anywhere from $586 thousand to $1.5 million per game[17]. With tight budgets and a faltering economy, these paydays represent significant means of subsistence for the small athletic departments of non-BCS and FCS schools. This complete financial reliance upon BCS schools serves to further prove that non-BCS schools should in fact be relegated to Division I FCS as they are not financially self-reliant.

In consistently scheduling this way, BCS conference schools are failing to realize that their fans are no longer tolerant, especially those watching on television. Sparse fan attendance at these meaningless non-conference games show that they are no longer willing to shell out their hard earned money for non-marquee match ups against weaker opponents. Fans at home are even starting to tune out these non-conference games against non-BCS conference and FCS schools, and tuned out fans is exactly what television executives do not want. With only 64 teams, 5 BCS conferences, and an 8-team playoff remaining in the downsized Division I FBS, the necessity for 12 regular season games disappears as the incentive to schedule weaker non-BCS opponents decline due to bowl eligibility rules[18], and the need to impress the at-large selection committee.

The new downsized FBS and regular season forces college teams to heavily reconsider who the schedule in their two non-conference games. Texas fans would no longer have to endure a myriad of non-conference games against the likes of Rice, Wyoming, New Mexico, and Florida Atlantic. Alabama fans would no longer sit through slaughter fests against teams like Kent State, the Citadel, and North Texas. With three at-large berths up for grabs, more non-conference games against teams in the Top 25 will significantly increase as the 64 BCS teams look to bolster their season resume for the selection committee, leading to a much improved on the field product, higher television ratings, and larger revenue per game. And better non-conference games against highly ranked opponents mean more money for all involved. This past year LSU earned $3.25 million to $3.5 million for their non-conference neutral site game against Oregon, which eclipsed the net revenue of $2.2 million that LSU hauled in for a home game against a non-BCS level program[19]. In essence, new scheduling requirements and considerations would force each BCS team to trade four lower quality lower revenue games for two higher quality and significantly more revenue games.

Using this past year (2011-12 season), I have outlined the parameters and key dates of the new ten game regular season and 8-team playoff postseason below and have included a detailed calendar of this modified 2011-12 seasons in Appendix A:

· 8 conference games and 2 non-conference games

· Conference partnership for neutral site non-conference games that rotate every two years:

v Big Ten vs. Pac-12

v Pac-12 vs. Big 12

v Big 12 vs. SEC

v SEC vs. ACC

v ACC vs. Big Ten

· Begin season Labor Day Weekend on Thursday, September 1

· Regular season would last for 12 weeks ending on Saturday, November 19

· Conference championship games would be played on Friday, November 25 and Saturday, November 26 following Thanksgiving

· Selection Sunday would occur on November 27 for the three at-large teams and seeding of eight playoff teams

· 10 days of academic break for final exams would begin Monday, November 28 and end Thursday, December 8.

· Non-BCS bowl would be eligible to begin Friday, December 9. Non-BCS bowl season would end Saturday, December 31.

· Non-BCS bowl games will take place concurrently with the BCS playoff but not game will occur on the same day as a playoff game.

· First round playoff games would occur on Friday, December 16 and Saturday, December 17

· Second round playoff games would occur on Saturday, December 24

· Championship game would be held on Monday, January 2

Shortening the regular season from 12 to 10 games will lead to a much improved on the field product in terms of non-conference games which will lead to more revenue per non-conference game for all 64 BCS schools. Estimates show that neutral site non-conference games between highly-ranked opponents net a premium of 40 to 60 percent over home games against non-BCS opponents18. Big schools would be able to earn in excess of the average two to five million in revenue per home game that they currently generate. They would also be able to keep more of this revenue as they would no longer have to cut large checks to their non-BCS opponents for their “guaranteed games” like they currently do. This reduction in the number of non-conference games will also add integrity and relevant back to the regular season, something that has slowly been declining during the BCS era.

Adding strategic conference partnerships for non-conference game scheduling would serve to only further the integrity of regular season non-conference and would also give further leverage to each conference in their future negotiations with television executives regarding their regular season conference television deals. This would more than likely result in increased television revenue for all five BCS conferences above and beyond the current record deals that each conference currently enjoys.

But more important than the financial gains that arise from the reduction of the regular season is the academic gains that will occur. A shortened regular season significantly helps with the academic missions that each of the 64 BCS schools should be primarily concerned with in the first place. By shorting the required number of games in the regular season, student-athletes will naturally have more time to devote towards the completion of their degrees. The ten day break after Selection Sunday will also give players a much needed rest to heal, recharge, and study. Not to mention it will also give coaches adequate time to prepare for their playoff opponent.

In closing, a shortened regular season to ten games simply replaces two low revenue generating non-conference games between a BCS school and an overmatched opponent with two rounds of more meaningful playoff football. By implementing a shortened regular season Division I FBS would be choosing more lucrative postseason games over less lucrative and meaningless non-conference games generating more revenue for the entire system.

To borrow directly from Death to the BCS by Wetzel, Peter, and Passan, any proposed changes to the current BCS must include the following three parameters:

1. Must be more profitable in every imaginable way for colleges and universities

2. Must protect, if not increase the value of the regular season

3. Must take academics into consideration, if only so presidents can save face for their long-standing hypocrisy on the issue

The proposed changes outlined within this paper show that college football can in fact make more money than it is currently making. Each of the proposed changes increase the overall value of college football while both respecting academic concerns and protecting the regular season. Appendix B and C further outline the total estimated valuation of college football currently and post modification.

Conclusion

Despite the unmistakable drag on ratings caused by the marginally exciting postseason matchups generated by the BCS, the college football postseason television package remains one of the hottest properties in all of televised sports. History shows that CBS, NBC, and ABC are willing to battle for the rights to broadcast college football. Consequently, there is a significant opportunity for college football to capitalize on television executives’ willingness to dole out large checks and increase the overall size of the college football revenue pie.

The Bowl Championship Series (BCS) was created in 1998 to provide a championship game between the two best Division I FBS college football teams. Since its inception, the BCS has undergone multiple alterations in an attempt to fix the multiplicity of issues that have arisen. But the current system still leaves a lot to be desired by college football fans.

Today, I believe that the issue that looms largest for the BCS is the declining popularity of college football’s postseason among its fans and underlying this is the undeniable fact that college football needs to create a more compelling postseason story. Even the executives of the current BCS are finally starting to realize this point. With the current BCS deal expiring at the end of the 2013 season and a new BCS cycle scheduled to resume in 2014, the time is now for BCS executives to seriously consider a playoff format for college football’s postseason. The BCS in its current form isn’t doing the job it set out to do and the power that be understand that a college football playoff system is inevitable … It just needs the right product.

Appendix A. Modified 2011-12 Regular Season and Postseason Calendar:

Appendix B. Profitability of the Current Division I FBS BCS System: Regular Season and Postseason:

The current system generates roughly $3.1 billion a year for 120 teams:

Appendix C. Profitability of the Proposed Modifications to the Division I FBS System:

The proposed modifications generate roughly $3.4 – $4.2 billion a year for 64 teams.

v Wetzel, Dan; Peter, Josh; Passan, Jeff (2010). Death to the BCS: The definitive case against the Bowl Championship Series.London, England: Gotham Books

v Dunnavant, Keith (2004). The Fifty-Year Seduction…How Television Manipulated College Football, from the Birth of the Modern NCAA to the Creation of the BCS. New York, New York: Thomas Dunne Books

v Hearing Before the Committee on the Judiciary United States Senate, October 29, 2003. BCS or Bust: Competitive and Economic Effects of the Bowl Championship Series on and off the Field.

Nielsen Television ratings:

v Football TV Ratings Soar: The NFL’s Playbook for Success(2011). Published: Friday, January 28, 2011. Retrieved March

Attendance Records

Television Contracts

Non-Conference Scheduling

v Pair, Brittany F., Moore, Christian S., Dittmore, Stephen W (2009). Paying for Wins: An Examination of Football Non-Conference Game Scheduling by BCS Schools, 1994-2009. University of Arkansas. Presented April 21, 2010 at the College Sports Research Institute’s Scholarly Conference on College Sports.

Playoff Proposal

[1] Hearing Before the Committee on the Judiciary United States Senate, October 29, 2003. BCS or Bust: Competitive and Economic Effects of the Bowl Championship Series on and off the Field.

[2] Please note that the 2011 Fiesta Bowl matchup was Connecticut vs. Oklahoma which obtained a Nielsen rating of 6.15. As a result, the significant percentage increase for the 2012 Fiesta Bowl can be considered an trend outlier

[3] Solomon, Jon. College football’s average bowl rating drops to lowest during BCS era. The Birmingham News of Nielsen Media Research. Published: Friday, January 13, 2012

[4] Please note that Nielsen ratings are not finalized for the 2012 NFL playoffs at the time of this writing.

[5] Wetzel, Dan; Peter, Josh; Passan, Jeff (2010). Death to the BCS: The definitive case against the Bowl Championship Series. London, England: Gotham Books

[6] Dunnavant, Keith (2004). The Fifty-Year Seduction…How Television Manipulated College Football, from the Birth of the Modern NCAA to the Creation of the BCS. New York, New York: Thomas Dunne Books

[13] Notre Dames current deal with NBC gives them $15 million a year. The Big 12 TV deal gives the conference $150 million per year. With equal revenue sharing across its 12 members, Notre Dame’s portion of conference revenue is $12.5 million.

[17] Paying for Wins: An Examination of Football Non-Conference Game Scheduling by BCS Schools, 1994-2009 by Brittany F. Pair, Christian S. Moore, and Stephen W. Dittmore. University of Arkansas. Retrieved January 12, 2012, http://www.slideshare.net/sdittmore/bcs-college-football-schedulinghttp://www.slideshare.net/sdittmore/bcs-college-football-scheduling

[18] The NCAA limits the number of victories over FCS teams that FBS teams can count towards the required number of wins to one.

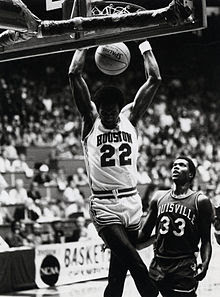

Behind the leadership of the flashy Clyde “The Glide” Drexler and always reliable Hakeem “The Dream” Olajuwon (a fellow Nigerian), the Houston Cougar’s experienced unprecedented levels of success, advancing to the NCAA Final Four each year during the period of 1982 to 1984. But for all their success, the Cougar’s never won it all and my father suffered for it.

Behind the leadership of the flashy Clyde “The Glide” Drexler and always reliable Hakeem “The Dream” Olajuwon (a fellow Nigerian), the Houston Cougar’s experienced unprecedented levels of success, advancing to the NCAA Final Four each year during the period of 1982 to 1984. But for all their success, the Cougar’s never won it all and my father suffered for it.