Measure What Matters Using Objectives and Key Results (OKRs)

Introduction

Measure What Matters is a business book by John Doerr based on the fact that ideas are easy but execution is hard. When it comes down to it the core model of execution (Objectives and Key Results – OKRs) in this book sets out to help organizations in there major ways:

What’s an Objective and What’s a Key Result?

At the most basic level, Objectives are the “what” you are trying to accomplish. Objectives express goals, intentions, are aggressive, and realistic. Above all though, they are tangible and must provide clear value to your organization. At the most basic level, Key Results are the “hows.” Key Results express measurable milestones that advance forward the objectives. Together, Objectives and Key Results form the framework of Doerr’s operational model within Measure What Matters.

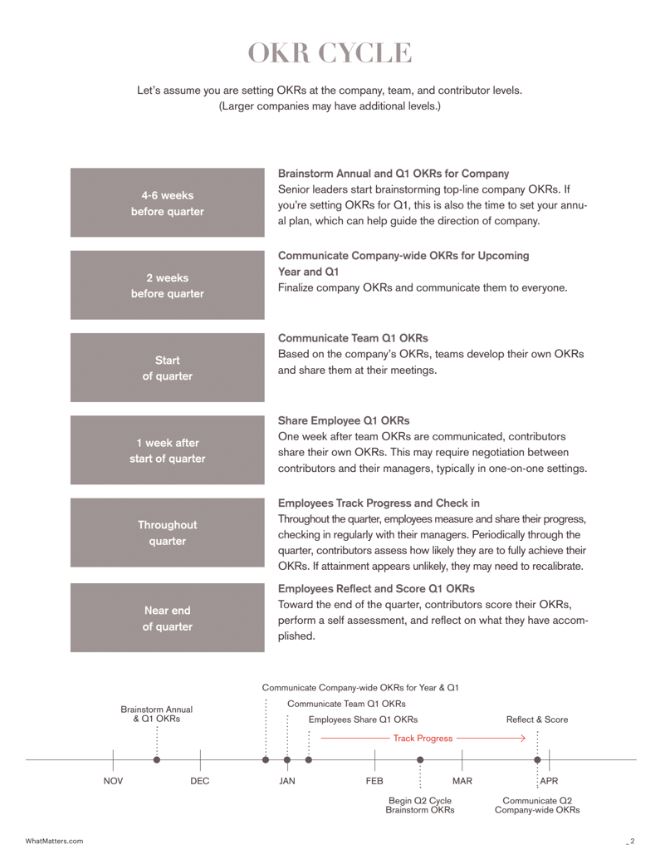

A Typical OKR Cycle

The typical OKR cycle for setting OKRs at the company, team, and contributor levels looks something like this:

Great. I Understand OKRs at a High Level. How Do I Actually Use Them?

(2) There is zero doubt what the organization (in this case an NFL team) is focusing on accomplishing this year.

(3) Poorly defined OKRs are a waste of time. Well defined and aspirational OKRs are motivational management tools that help your company execute.

(4) The very nature of the OKR process is to think big but focus and this hypothetical OKR does exactly that.

Is It Really That Simple?

The short answer is yes and no. The principles within Objectives and Key Results are easy to understand. The complexity lies in writing really good Objectives and really good Key Results. As Measure What Matters details within the appendix on Google, it can be very hard to consistently write good OKRs when you first start out. Like any new process, it takes time to get really good at it.

Extras

Build an Emergency Fund to Protect Yourself During Unexpected Life Events

Purpose of this article: to define the emergency fund and help you put together a plan to increase yours.

Bullet Point Summary

- Building an emergency fund to cover 3-12 months of expenses will take time

- Focus first on saving $1,000 as soon as possible

- Commit to saving all windfall payments you receive like tax refunds or any year-end company bonuses

- Over the long-term you will need to spend less to save more and look to make more income overall

- Building a good budget that helps you cut back on spending will be key

- Save any yearly raise received. 1% to 3% can add up quickly

- Rinse and repeat until you hit your goal

Overview

Ask any financial planner and they will tell you that an emergency fund is a must. Some will suggest you save upwards of three months of expenses while others will tell you one full year. In this article we discuss the ins and outs of the emergency fund and conclude by giving you strategies to boost your emergency funds.

What Are Emergency Funds For?

The ultimate point of the emergency fund is to set aside cash to cover your most basic needs during an unexpected life event. We all have differing wants and desires in life, but our basic biological requirements for survival are the same. When push comes to shove, we need air to breathe, food and drink, a place to lay our heads at night, and clothes to wear, as depicted in Maslow’s Hierarchy of Needs:

Consequently, an emergency fund needs to be established to cover unexpected financial situations like the eviction from an apartment, loss of a job, medical bill, or temporary disability to name a few. In these situations, you’ll need immediate access to cash to cover your most basic expenses and needs while you get your financial situation back on track.

Is There a Right Number?

In a 2018 article, CNBC found that only 39% of Americans had enough savings to cover an $1,000 emergency. Defining the “right number” for an emergency fund is hard because financial emergencies by their very nature are unplanned and their lengths unknown. Instead, we suggest thinking through some of the larger types of unexpected life events that could cause you to dip into your emergency fund and planning specifically for those:

- Loss of steady income from primary job – it takes roughly one month per $10,000 you make to find job per thebalancecareers.com. So a person making $50,000 a year would need at least five months of income saved up (roughly $21,000) to tidy themselves during their job hunt.

- Major medical expense – the average emergency room visit can cost $1,200 to $2,200 without insurance. Other hospital costs like X-rays and surgical procedures can average over $3,900 with hospital stays costing over $15,000 without insurance. And these days it feels like there is no upper bound on medical bills even with insurance.

- Car repairs and maintenance – depending on the severity of repair, costs can range from $300 for a water pump replacement up to $3,000 for a transmission replacement.

- Major household repairs – similar to car repairs the cost of household repairs will very with the severity of the repair. An new HVAC system can cost 3,800+ while a new roof can run into the tens of thousands.

Using these four large unplanned expense, we build the following table to give you suggested savings targets at differing levels of income:

Short-Term Steps to Build Your Emergency Fund Over Time

It will take time to build a robust emergency fund with three to twelve months of expenses. With competing interests like saving for retirement and paying down debt, it can be difficult to find the extra cash needed to build your emergency fund. The following are the first couple of steps you can take in the short-term that will allow you to build temporary cushion for emergencies.

Your first step will be to save $1,000 as soon as possible. As we mentioned above, only 39% of Americans had enough savings to cover an $1,000 emergency. By focusing here, you are giving yourself a tangible goal that will help give you real cushion against any financial emergencies in the short-term. Set up an automatic transfer from your checking account to an online savings account like Ally of at least 3% of each paycheck. Someone making $40,000 would have over $1,000 in one year:

Your second step will be to save all windfall payments you receive like tax refunds or any year-end company bonuses you may receive. In the past tax refunds had averaged close to $2,100, but this year that was down to about $1,950. Even still, you should put this injection of cash directly into your emergency fund and get one step closer to peace of mind.

These steps are meant to help you build a temporary cushion for emergencies in a short amount of time. Once you complete these steps you will switch your focus to paying down debt if you are not debt-free. And once you are debt-free you will refocus on aggressively building a more robust and complete rainy day fund to cover three to twelve months of expenses.

Long-Term Steps to Build Your Emergency Fund Over Time

It will take time to build a robust emergency fund with three to twelve months of expenses. You should view view building enough emergency savings as a long-term project that will get easier as you free up more cash from the burden of life’s expenses.

Over the long run it will be important that you do two things very well: (1) spend less to save more and (2) make more income. As simple as this may seem, these two factors are the key to building your emergency fund in the long-run.

In order to spend less you will need to build a good budget that helps you cut back on spending. Knowing exactly how much you spend monthly will be key and we suggest using a digital app like Mint or You Need A Budget to track your expenses. The ultimate goal is to bring light to your monthly cash inflows and outflows which will help you free up funds to accelerate the growth in your cash reserves.

Boost your savings by bringing in more income through a side hustle or part-time job even if only temporarily. Make sure to save any yearly raises received. The average pay raise is around 3%, so a person making $40,000 would have an additional $1,200 to save towards the emergency fund over the next year.

Continue to execute the short-term and longer-term strategies discussed above until you hit your goal of three to twelve months of emergency savings.

Conclusion: Remember It Takes Time

An estimated 530,000 families go bankrupt each year because of medical issues, so it’s clear that medical expenses are a big unplanned life event. On top of unplanned medical expenses, there are a ton of other life events that happen unexpectedly that can derail your longer-term financial plans.

The only way to ensure that you will be truly financially secure in times of crisis is to build a robust and well-padded emergency fund. It takes some real time and effort to build a robust enough emergency fund that can handle three to twelve months of expenses, but it’s absolutely doable. We hope the strategies detailed within this article will give you a good enough guide to start building your emergency fund.

Active Investing to Beat The Market is Inconsistent

Purpose of this article: to convince you that a switch to passive investing will boost your chances of hitting your long-term investing and wealth generating goals

Bullet Point Summary

- Since 1926 the entire gain in the U.S. stock market is attributable to just 4% of stocks.

- Well over 40% of stocks generated 0% return since 1989 and underperformed even Treasury Bills.

- To top this off, the top 86 stocks have created 50% of the total $32 trillion generated in the stock market from 1926 to 2015.

- These improbable sounding stats point to a mathematical principle called Positive Skew, which ensures that only a handful of active investors will pick and own the right stocks that turn into big winners.

- The Positive Skew of stock market returns ensures there will always be more losers than winners.

- Consequently, switching to passive investing and indexing is the only tangible and consistent solution to combating the dynamic of Positive Skew.

Overview

I consider myself an educated investor that at best can generate okay to modest returns on average. Even though I take the time to evaluate individual stocks, invest in companies at “the right” price point, and hold for the long-term, I can’t consistently generate over-the-top returns in my active portfolio. And neither can many of my smart counterparts on Wall Street with their enormous informational and financial resources.

Inherently I have always known that trying to beat the market is a fool’s errand. And while books like Fooled by Randomness and A Random Walk Down Wall Street remind me of the difficulties of consistently besting the market, it was an article on Bloomberg I recently read that put the nail in the coffin of active investing for me.

The thesis of the article is very simple:

Not only can’t humans outdo benchmarks, we can’t even fight them to a draw.

Why Do We Suck So Hard at Consistently Picking Winners?

While it is important for active investors to do their homework when it comes to compiling an investment strategy the actual reality of the stock market is that all this effort is futile. When push comes to shove the fundamental reason why active investing sucks so hard is that the distribution of returns in the stock market is bizarrely lopsided.

Because of the statistical principle of Positive Skew (see picture below), only a handful of active investors will pick and own the right stocks that turn into big winners. The rest of the market simply will not.

The Positive Skew of stock market returns means that there will always be more losers on the left side of the distribution than winners who end up on the right side of the distribution with better than average returns.

History Clearly Shows Stock Picking Losses for Most Active Investors

The math and statistics are simply not in your favor if you are an active investor. The nature of the stock market is such that the odds are stacked against active investors when it comes to consistently picking winners. On average, there will be a small number of extreme winners, a small number of extreme losers, and a ton of stocks that will oscillate around average performance. As a result, most everyone outside of an indexer owns mostly deadbeat stocks.

The following chart from A Wealth of Common Sense shows exactly this as well over 40% of stocks generated 0% return since 1989 and underperformed even Treasury Bills.

And in 2017, Hendrik Bessembinder found that since 1926 the entire gain in the U.S. stock market is attributable to just 4% of stocks. And to top this off, he also found that the top 86 stocks created 50% of the total $32 trillion generated in the stock market from 1926 to 2015.

Just stop for a second and let that all sink in… And once you have, call your active money manager and request a change in strategy.

Conclusion: Switch to Passive Investing

For most of us, switching to passive investing and indexing is the only tangible and consistent solution to combating the dynamic of Positive Skew. With active investing comes a much greater chance of underperformance that inherently comes when you attempt to pick stocks. And consequently, active investors need to realize that the statistical disadvantage of Positive Skew is an uphill battle that most of them will lose.

It’s simply impossible to actually know which companies will be the outsized winners (think about trying to place a bet on Amazon and Google circa 1998). The only real option is a diversified passive investment strategy which spreads your investment dollars across a lot of different companies. This simplistic and effective approach is best positioned to beat the statistical dynamic of Positive Skew in the stock market.

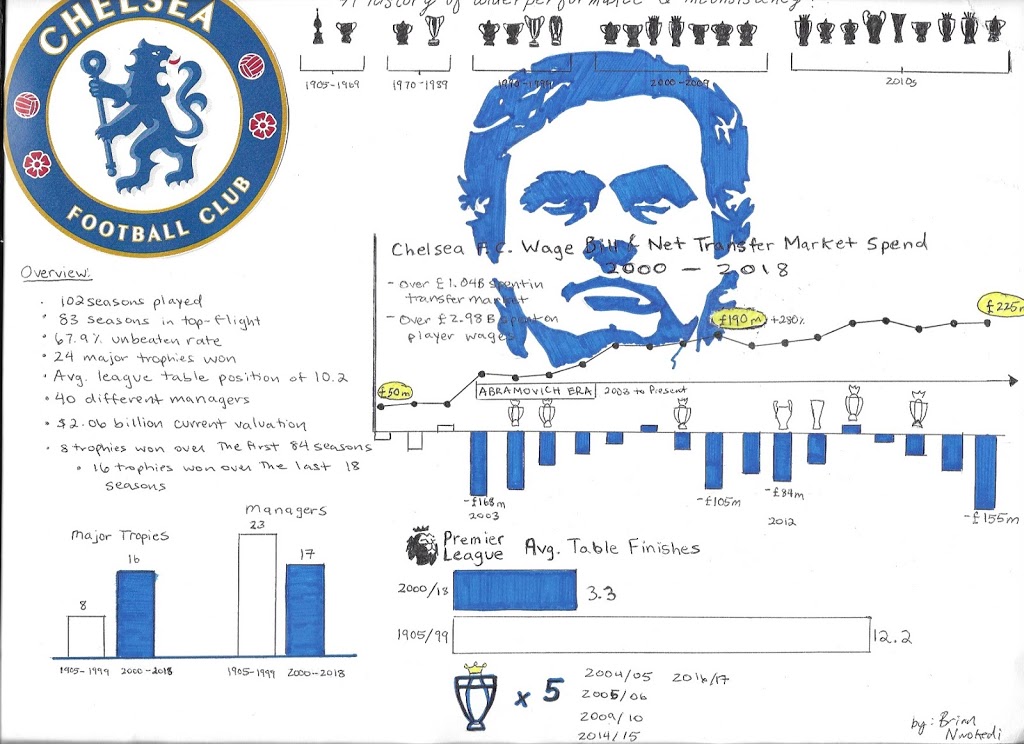

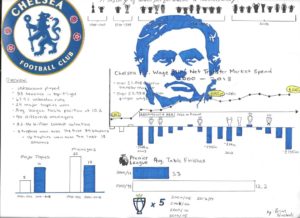

Chelsea F.C… A History of Money, Under-performance & Inconsistency

Introduction

In January 2005 while abroad at Queen Mary University of London, I played a semester of club rugby, met a ton of friends for life, and immersed myself in Premier League Football. There were two “gentlemen” on the team I got on really well with, Teflon John and Mr. Dyson, whom both happened to be long-time Chelsea F.C. supporters. It is often said you don’t pick your team; it picks you, and in 2005, the Blues picked me.

From Gus Mears to Roman Abramovich, Chelsea F.C. Have Benefited from Two Ambitious Moneyed Patriarchs

Stamford Bridge is the Crown Jewel of Chelsea F.C. but Home Support Lacks Fervor

Chelsea F.C. Players Have Always Been a Tad Over Paid. They Just Achieve More Silverware These Days

One of the biggest things I learned from Rick Glanvill’s book is that even prior to Roman Abramovich, Chelsea have always been a team that has had the money and the large crowds. What’s different now, is the success as measured in trophies. Undoubtedly some of the best footballers of each generation have played for the club (Greaves, Tambling, Bonetti, Osgood, Bridges, Venables), but prior to Abramovich and Jose Mourinho, they have failed dismally to consistently bring home silverware. Historically, Chelsea F.C. have been seen as a club that collects talented players that don’t blend well. But all of this changed after 2003. The following is a visual representation of what Chelsea F.C. has morphed into as a result of Roman Abramovich’s and eventually Jose Mourinho’s impacts:

Where Do We Go from Here? Chelsea F.C. Will Always Be London’s Bohemian Football Club

-

-

The club is currently underperforming with Maurizio Sarri as manager, and this underperformance may cause them move on from yet again another manager.

-

The pending transfer ban coupled with some consistent misses in the transfer market have left them once again with a miss match of players that don’t all gel together.

-

A real concern over whether Roman Abramovich is fatigued at this point as Chelsea F.C. owner. Their model now looks to be outdated

-

Stamford Bridge is once again a problem as the club desperately need to figure out how to expand the capacity of its home ground. Looking to their North London rivals and seeing Arsenal’s home ground and Tottenham’s new home ground each with capacities of 60K+ must not feel great, especially as their original redevelopment plans have been shelved given Roman Abramovich’s “issues.”

-

The club still doesn’t have a technical director. Historically, Chelsea F.C. have a history of football directors that lack knowledge of football and don’t take a back seat to those with the knowledge. With out a technical director, major decisions seem to fall on the plate of Marina Granovskaia, long-time confidant of Roman Abramovich.

-

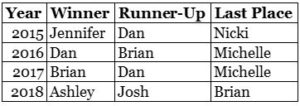

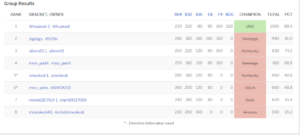

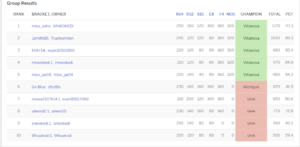

The Nwokedi-Allen Bracket Challenge… A History of Bad Picks, Heats, and Genuine Good Fun

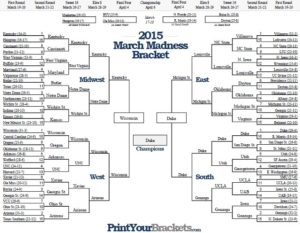

2015 Highlights

In 2015, Duke beat Wisconsin in the National Championship game. Kentucky and Michigan State made the Final Four. In the Nwokedi-Allen Bracket Challenge, every single one of us picked Kentucky as the champion except for my sister Jennifer, her husband Josh, and my wife Nicki. Consequently, that year’s winner was Jennifer and my wife Nicki finished last.

2016 Highlights

2017 Highlights

Conclusion

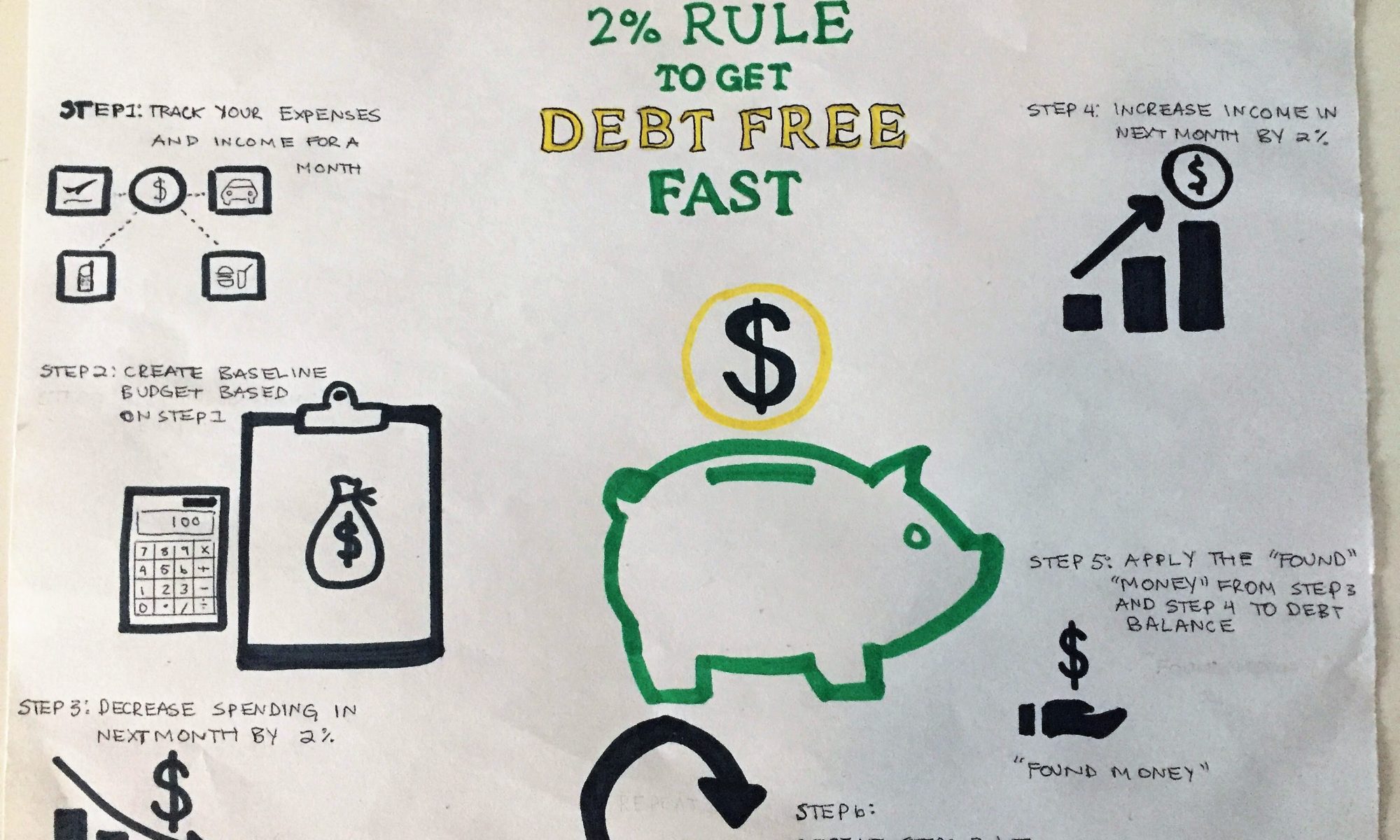

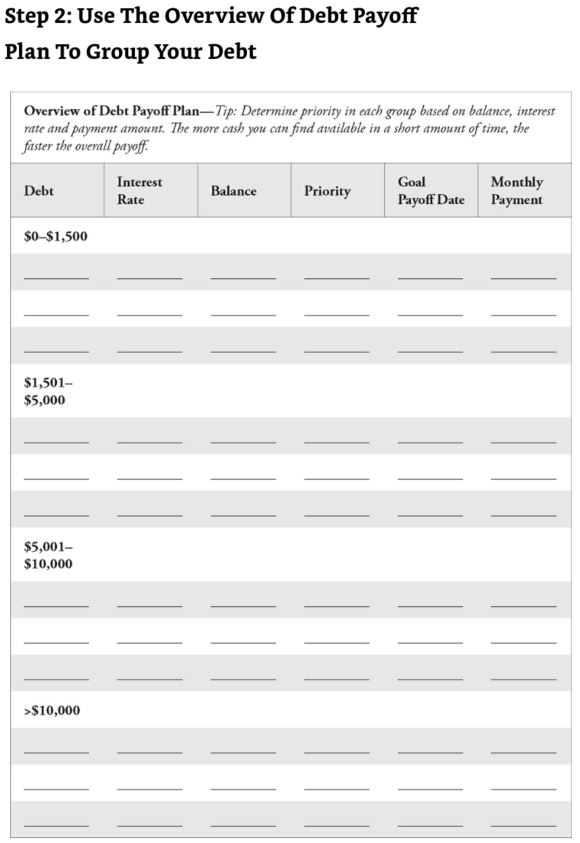

Get Debt Free Fast with the 2% Rule

Purpose of this article: to give you a strategy based on a recent book I read to get out of debt fast and sustainably. Please note that we are not paid to recommend books like this, and our decision to do so is solely based on our positive experience with the material.

Bullet Point Summary

- The strategies detailed within are based on the book “The 2% Rule to Get Debt Free Fast.”

- The main focus of this approach: make incremental 2% changes to the way you behave with money over time.

- Put even simpler, for every $100 you spend monthly, see if you can reduce that amount by $2. Then rinse and repeat for the next month.

- Much like gradual fitness or diet improvement plans, The 2% Rule is designed to make you gradually better each month with money, 2% at a time.

- Small cuts can go a long way and the strategies detailed within The 2% Rule leverage this.

Overview

I recently completed a book by the founders of The ThrifyCouple.com called The 2% Rule to Get Debt Free Fast. And while the content was far from earthshattering, the strategies detailed within are simple, effective, and sustainable for anyone trying to get out of debt. In essence, the thesis of this book is to simply make incremental 2% changes to the way you behave in regards to your money. The following article is a deeper dive into the concepts discussed within this book. My hope is that after reading this post, you will be enticed to read the book, and pick up some strategies to help you along your get-out-of-debt journey.

Start with Six Small Steps

The 2% Rule to Get Debt Free Fast starts with the following six small steps:

- Track your expenses and earnings for a month

- Create your baseline budget based on the results from Step 1

- Decrease spending the following month by 2%

- Increase income the following month by 2%

- Apply the “found money” from Step 3 and Step 4 towards your financial goal of getting out of debt

- Each month repeat Steps 3 through 5

By tracking your expenses and earnings for one month, you will get a feel for what you normally spend and make each month. From there you can then start to implement the incremental 2% improvements that the strategies in this book call for.

Six Small Steps in Action

Using the six small steps and a sample Client A, this is what the 2% Rule looks like in action:

- Step 1 & 2: For the month of November 2018, total income and total expenses for sample Client A were exactly $3,000. As a result, the “found money” was $0.

- Step 3: The planned expenses for December 2018 are $2,940 which is 2% lower than November 2018 baseline

- Step 4: The planned income for December 2018 is $3,060 which is 2% more than November 2018 baseline

- Step 5a: Actual income and expenses for the month of December 2018 created a “found money” positive gap of $120. It’s important to note that Client A still obtained a $120 “found money” positive gap even though their income didn’t increase. This is because Client A reduced their expenses by more than the 2% plan.

- Step 5b: Use “found money” positive gap to pay down debt. Remember that your monthly expense already includes a debt paydown in there. So this positive “found money” gap is incremental payments on top.

- Step 6: Apply the same 2% increase in income and 2% decrease in expenses to the actuals for December 2018. Rinse and repeat every month from here until you crush your outstanding debt balance.

Why This Approach Works?

This strategy works simply by leveraging the laws of incremental positive change. The focus each month is to simply be 2% better than you were the last month. This plan is designed in such a way to help you use gradual progress to meet your financial goal of getting out of debt. Other get-out-of-debt strategies require you to make drastic cuts that can really only be maintained for brief intervals. It’s like all of those fad/crash diets when you are trying to lose weight.

Instead, the 2% Rule gives you a gradual approach towards cutting your budget and expenses that can actually result in a more realistic plan that works. In closing, if you are motivated to begin your debt payoff journey and are looking for a strategy that may benefit you, please check out the 2% Rule to Get Debt Free Fast. It gives you a very good roadmap to follow towards debt freedom and also has a tone of other long-term financial goals and objectives. I highly recommend this book because of its simplicity and high degree of likelihood to be followed.

Usefull Materials – See Below

Anna Karenina

19th-Century Imperial Russia is a Hard Place to be a Woman

Big Themes in this Book

It’s a man’s right to be unfaithful to his wife in the face of her unyielding fidelity, and throughout this book you get the sense that it’s less serious for a husband to stray than a wife since family unity depends on the woman.

Term Life Insurance is a Must Have

Purpose of this article: to explain the importance of getting a term life insurance policy as soon as possible, especially if you have a spouse, partner, or dependent child (children).

Bullet Point Summary

- We recommend a term life policy over all other types of life insurance policies.

- Term life insurance policies provide death benefits to the policyholder’s beneficiaries if that person dies within the specified term of the policy.

- Terms are usually set at 10, 20, or 30 years and the term you choose is specific to your needs and expectations.

- General rule of thumb in deciding the amount of policy to take out: Take your annual salary, and multiply by 5 or 10 times.

- If anyone in your life is financial dependent upon you and your income, term life is an absolute must have.

Overview

There are many types of life insurance policies that provide a variety of benefits to the policyholder’s beneficiaries, but our recommendation is that you consider a term life insurance policy over all the others.

Term life insurance policies are better than the rest for a few specific reasons:

- The overall monthly premium (rate) usually costs less than the other types of life insurance options and once locked in, it will not change.

- The period of time for the policy’s life is set in very easy to understand terms (usually 10, 20, or 30 years).

- The policy can be cancelled at any time simply by not paying the monthly premium.

- It’s very easy to understand and very much straightforward especially compared to the other insurance products out there.

The rest of this article will help you better understand the nuances of term life insurance policies and get you comfortable with why we believe you need to get one as soon as possible.

What Exactly is a Term Life Insurance Policy?

A term life insurance policy provides a death benefit to the policyholder’s beneficiaries if that person dies within the specified term of the policy. The specified terms are typically set at 10, 20, or 30 years. This death benefit can be paid in one lump sum or in monthly installments.

The monthly premium (rate) for your policy is determined by actuaries and underwriters who use a variety of factors like your age, health, occupation, hobbies, and driving records to calculate the risk of insuring your life. Once risk is assessed, the monthly premium (rate) will be set by the insurance company based on this assessment, the specified term, and the size of the policy.

How Much Will Your Term Life Insurance Policy Cost?

A term life insurance policy is typically the cheapest way to purchase life insurance coverage. Rates will very based on length of the policy, amount of the policy, and overall health of the insured.

Using ValuePenguin the following are visual representations of monthly premiums for term life insurance at differing levels of health (Preferred Plus, Select, Standard) and differing levels of coverage ($250K, $500K, $1M).

$500K policy varies in monthly premium from a low of $22 to a high of $268

$1M policy varies in monthly premium from a low of $38 to a high of $508

You will notice that with term life insurance it can cost you as little as $15 a month to as much as $500+ a month depending on your age, health, term, and policy amount. In general, with term life insurance, it’s markedly cheaper the earlier you get it because a policy issued later in life has a greater likelihood of paying out. So, for your 20-somethings and 30-somethings reading this… GET YOUR POLICY TODAY!

What Amount Should I Choose?

Choosing the right term life insurance policy in terms of length and size is difficult because every single person’s situation is different. The amount you will need will depend on factors like your other sources of income, how many dependents you have, your debt levels, and in general your overall expectations on the lifestyle you want to live.

But with that said, you can apply the following general rule of thumb to find the starting baseline policy amount: Take your annual salary, and multiply by 5 or 10 times. The following chart details term life policy amounts based on annual salaries and the general rule of thumb:

What Term Should I Choose?

When you purchase term life insurance you will have to choose how long your coverage will last. Usually the terms are 10, 20, 30 but some insurance providers offer other terms. Based on our understanding of term life insurance policies and our work with some of our clients, the terms can be summarized as follows:

- 10-year policies are popular for those people who are on a very tight budget and probably won’t require insurance after their term expires. We usually recommend this for someone in their late 40s to early 50s.

- 20-year policies are the most popular, and are usually recommended for young families who often have large debt levels (school loans and mortgages) that would become troublesome if one of the breadwinners of the family happened to die unexpectedly. We usually recommend this for someone in their late 30s to early 40s.

- 30-year policies are awesome because your monthly premium will remain unchanged during the duration of that period even though your health will likely change during the same time period. Because you lock in your rate in your late 20s and early 30s when you are healthiest, your premiums will remain the same. We usually recommend this for someone in their late 20s to early 30s.

Closing

Suze Orman is quoted as saying, “if you want insurance, buy term; if you want an investment, buy an investment, not insurance. As we mentioned in the beginning, there are many types of life insurance policies out there, but at Blue Elephant Financial Services, the only one we recommend is a term life insurance policy.

If you have anyone in your life that is financial dependent upon you and your income, term life insurance is an absolute must have. It will secure their future against the loss of income that your death will bring. The only thing guaranteed in life is death and taxes. Use term life insurance to plan for one of the two!

My hope in writing this article is that after reading this, you will feel more comfortable with term life insurance thus making it much easier for you to take the necessary steps to acquire your own policy.

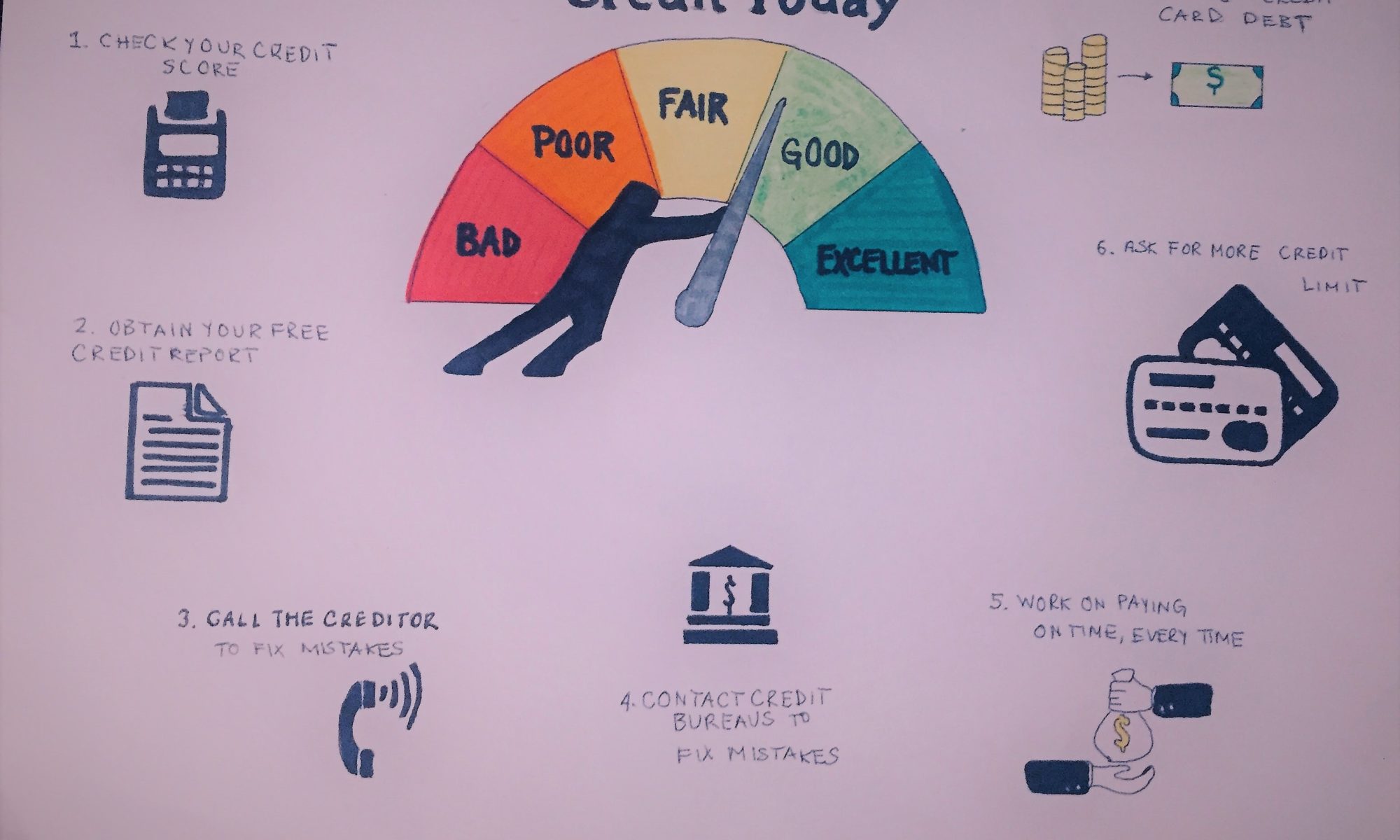

Start Repairing Your Credit Today

Purpose of this article: to give you some tips to start repairing your credit score day by day thus improving your ability to borrow money on better terms and your overall financial well-being.

Bullet Summary

- Repairing your credit score takes some time. The following are the seven easy steps to start fixing your score today.

- Always start by checking your credit score

- Next obtain your free credit report and verify that the information is accurate. This will help you know your starting point.

- Call your creditors and contact the credit bureaus when mistakes are found on your credit report.

- Commit to paying your bills on time, every time as this is probably the single most important strategy

- Ask for more credit limit from time to time to reduce your credit utilization rate down to 30%

- Take out a personal loan to consolidate your credit card debt into one if you can.

Overview

Rome wasn’t built in a day. In fact, based on a Google search, Rome was built in 1,009,491 days. And repairing your credit won’t happen overnight. It’s a bit like losing weight: It will take time and there is no quick way to fix it, but you HAVE TO START NOW!

Your credit score is based on your credit history which is the sum of all your financial activities over the past 7 to 10 years. As you repair your credit history, your credit score will naturally improve over time. But for most of us, we only think about our credit score right before we need to take out a new loan. The following article will hopefully help you take some pre-emptive steps toward repairing your credit score now.

The First Step is Knowing Where You Currently Stand

The time to start repairing your credit score is well before you really need it. But before you can actually take steps to improve your score, you need to know where you stand. There is only one true way to know where you stand and that is to pull your credit report from one of the three credit agencies: TransUnion, Experian, and Equifax.

You can obtain your free annual credit report from the following link here.

Once you obtain your credit report and review it thoroughly, you will have your starting point from which you will hopefully improve. For more information on the importance of your credit score please see our article entitled “Your Credit Score … Three Digits Can Mean A Whole Lot.”

Next Step is to Fix the Mistakes on Your Report

The unfortunate reality of financial life is mistakes happen. And while you and I both are perfectly infallible human beings (kidding of course) the credit agencies are not.

The most common mistake that shows up on your credit report and drags your credit score down is incorrectly entered late payments.

This occurs when a credit card provider or a mortgage lender fails to enter a payment correctly and/or timely.

Payment history is a significant factor in your credit score. Remember that over 65% of your credit score is based on your payment history and how much credit you have used up (credit utilization). Given this it is vital that you ensure all your payment history entries on your credit report are accurate.

When you find a payment entry that is incorrect (i.e. applied late), dispute this with either the creditor or the credit bureau directly. You can also move all of your credit payments to auto draft from your bank account to ensure that the payment is issued to the creditor/lender on time. At minimum, you should have all your minimum payments on auto draft so that you can ensure that your payments are processed on time, EVERY TIME!

Ask to Remove Negative Comments

You have probably heard the saying: “You get more with sugar than with salt.” And in dealing with the credit agencies and creditors this couldn’t ring truer. When you have a negative comment on your credit report for say a late payment, you can simply call up your creditor and ask them nicely to remove the negative comment. I kid you not, but plenty of our clients have been able to remove negative marks from their credit history by simply playing nice.

This is simply because creditors have the power to instruct the three credit agencies to remove entries from credit reports for any reason at any time. Put another way, your creditor can decide whether or not to grant you mercy simply by how you ask for “forgiveness.” So, if you do anything at all, please start by calling up all of your creditors and playing nice with them to see if they will remove negative comments/remarks for late payments and other derogatory actions from your credit report.

And While You’re Asking for Things … Ask for More Credit Limit

As we mentioned above, over 65% of your credit score is based on your payment history and how much credit you have used up (credit utilization). Asking for more credit limit will decrease your credit utilization and increase your credit score. Credit Karma has a great step by step on how to ask for more credit limit.

The bottom line is if you have bad credit already, asking for more credit limit will be tough but it is still worth doing because every extra dollar of new credit limit will improve the ratio of credit utilization which will positively impact your credit score. You just have to ensure that you don’t use up the additional available credit should you be approved.

Use a Personal Loan to Consolidate Multiple Credit Card Debt into One

At first glance, the idea of taking on more debt to pay off credit card debt might seem counter intuitive. But the reality is a personal loan can help you consolidate all of your current credit card debt into one single payment, usually at a lower interest rate.

A personal loan works as follows:

- You borrow funds from a creditor at an interest rate that is usually lower than the interest rates charged by your credit card provider.

- You then use the funds to pay off your credit card balances.

- Over time, you pay back the personal loan and thus reach a state of debt freedom

Personal loans are typically unsecured which means they don’t require the borrower to put down any collateral to obtain the loan, and the interest rate you pay depends on your credit score. Consider this … as of January 2018 the average credit card interest rate was higher than 16 percent[1].

So even if a personal loan has a higher interest rate than a secured loan, it will oftentimes be lower than the interest rate on your credit cards. Additionally, after consolidating your credit card debt into one, you will only have to make payments to one entity rather than all of the different credit card providers you had before.

Last but Most Important … Pay Every Bill on Time

The single most important strategy to repair your credit today is to commit to paying every single bill you have on time, every time. Just one late payment of 30 days has the potential to drop your credit score by 90-110 points. So, to say this is the most important step is a bit of an understatement.

Closing

Your credit history good or bad can impact your ability to buy a home, purchase a car, get a better credit card, get cellphone coverage, and even impact the type of employment opportunities you may have.

Repairing your credit score will take some time. On average, negative comments and remarks on your credit report remain on your report for about 7 – 10 years. Remember that your credit history is really just a story that tells future lenders how you manage your financial affairs. And everyone likes a good comeback story.

If you are just starting your credit repair journey, you can use the strategies discussed above to navigate this process. My hope in writing this article is that after reading this, you will take some steps towards successfully repairing your credit score.

[1] https://www.creditkarma.com/credit-cards/i/loan-pay-off-credit-card-debt/