Introduction

Do you believe that ability is fixed and needs to be proven? Or do you believe that ability can be developed through learning? Most of us would agree with the second statement. Yet in Mindset: The New Psychology of Success, Carol Dweck proves time and time again we humans often live in a fixed mindset (statement one), and often do so without even knowing it.

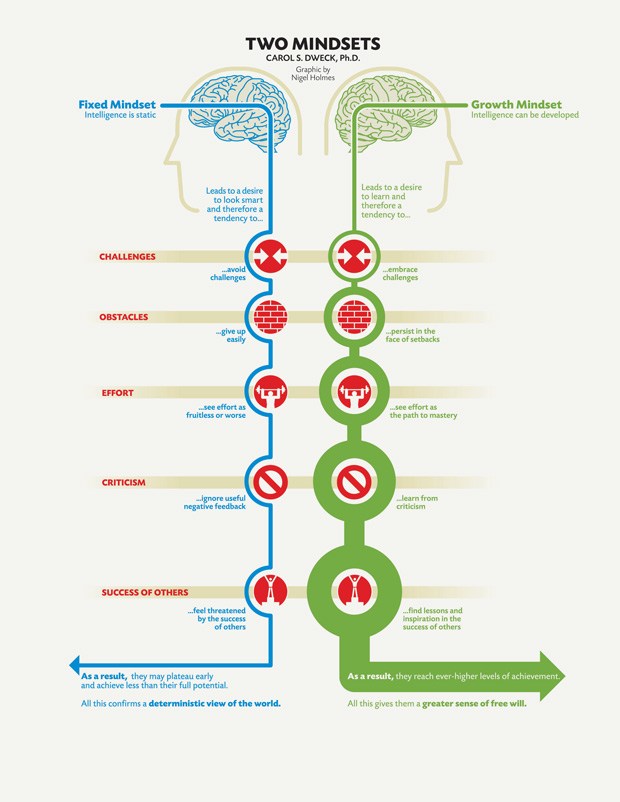

At the heart of Mindset: The New Psychology of Success, is a detailed walkthrough of two types of views you can adopt for yourself: (1) the fixed mindset and (2) the growth-mindset. Under the fixed mindset, you believe your qualities and that of others is cared in stone and this creates an urgency to prove yourself over and over. Under the growth-mindset, you believe that your basic qualities are things you can cultivate through your efforts, your strategies, and ultimately through learning. Each mindset can have profound affects on the way you lead your life and view life in general. The following blog post will unpack some of the things I learned through reading this book.

Inside the Mindsets

When you think of yourself under the eye of each mindset, you quickly realize that there are two meanings to everything the happens in life. Better said, there are two ways of seeing every interaction or happening… Two sides of the same coin. The following chart details the differences in mindsets across a few domains of life:

While far from exhaustive, the two lists above show pretty clearly that the fixed-mindset is limiting by its very nature. Yet Carol Dweck shows in her book that time and time again we have a hard time avoiding the fixed-mindset even though we understand that it hampers our ability to live our best life.

Don’t Buy Talent, Buy The Growth-Mindset

Sports has a funny way of helping us see things clearly (and often times less clearly [insert smiley face). When we think about the greatest athletes of all time in each of their domains, we don’t believe they got to their greatest heights by talent alone.

From Michael Jordan to Tiger Woods to Babe Ruth and back to Wilma Rudolph, we intellectually understand that talent + relentless hard work is the ultimate recipe for their success. Yet in our day to day lives, we shun this idea, oftentimes without even realizing. Malcolm Gladwell suggests that this happens because people prize natural endowment over earned ability. As much as our culture talks about individual effort and self-improvement, deep down, he argues, we revere the naturals.

The fixed-mindset can trick us into believing that natural talent should not need effort. In fact, those with the fixed-mindset even go as far as to think that effort in general is for the others, the less endowed. Carried away with their superiority, “these naturals” with the fixed-mindset never ask for help and never learn how to work hard nor cope with setbacks. This way of thinking can contribute to very negative outcomes Take a look at the following two images with quotes from two of the world’s greatest champions in sports:

Both Tiger Woods and Michael Jordan, two of the greatest athletes of all-time, clearly exhibit the growth-mindset. They stand out because of their commitment and effort to honing their craft. And this is the key to their overall success. People with the growth mindset think it’s nice to have talent, but that’s just the starting point.

Long-Term Corporate Health Needs Growth-Mindset Leadership

Evidence shows time and again, leaders with the fixed-mindset over the long-term lead organizations astray. From Lee Iacocca to Albert Dunlap, back to Ken Lay and Jeff Skilling, and over to Steve Cash and Jerry Levin, these fixed-mindset leaders fostered cultures of big egos, blind heroism, and entitlement, which eroded their company cultures and destroyed their chances at long-term sustainable corporate health.

Fixed-mindset leaders want to be the only big fish so they stifle others to make them feel a cut above the rest. These leaders foster environments full of negative assessments, stereotypes, and often prejudices that put their employees in the fixed-mindset ultimately holding them back from success. Instead of learning, growing, and moving the company forward, everyone within is more worried about being judged. This is why fixed-mindset leadership is so detrimental for long-term corporate health.

In contrast to these fixed-mindset heroes, stand growth-mindset leaders in action like Jack Welch, Lou Gerstner, and Anne Mulcahy that focused all their efforts in establishing cultures focused on learning, growth, and collaboration, not individual brilliance. Organizations steeped in the growth-mindset embody a zest for teaching and learning, an openness to giving and receiving feedback, and an ability to confront and surmount obstacles.

Working Towards a Growth-Mindset

Whether you are a parent, business leader, coach, spouse, or athlete, working towards the growth-mindset will have meaningful impact in your life. But how do we actually instill these principles in our lives? And how do we maintain the growth-mindset once “we get there?”

Moving towards a growth-mindset takes plenty of time and effort to achieve and maintain so it’s important to first understand this right at the outset. The growth-mindset starts with believing that all people can develop their abilities. This belief in people’s ability to grow and learn is the heart of the growth-mindset. Changing one’s mindset towards the growth-mindset also starts with a deep appreciation for hard work, trying new strategies, and consistently seeking input from others.

When you face setbacks, the growth-mindset is about responding with interest and treating these setbacks as opportunities for learning. In short, moving from a fixed-mindset to the growth-mindset is all about embracing all the things that have felt threatening: challenge, struggle, criticism, and setbacks.

Changing your mindset isn’t about picking up a few pointers here and there. It’s about seeing things in a new way. Embracing the growth-mindset is a way of life that will change you from a judge-and-be-judged framework to a learn-and-help-learn framework. It’s a journey that takes time but as Carol Dweck proves time and time again in her book, it’s a journey that is well worth taking.

In summary, the growth mindset looks a bit like this:

The Extras

Brian Nwokedi’s Book Review on Goodreads

Direct Link to Book: Mindset: The New Psychology of Success

Amazon Link to Book: Buy Here

Ted Talk: The Power of Believing that you can Improve

Follow on Twitter: Mindset Works