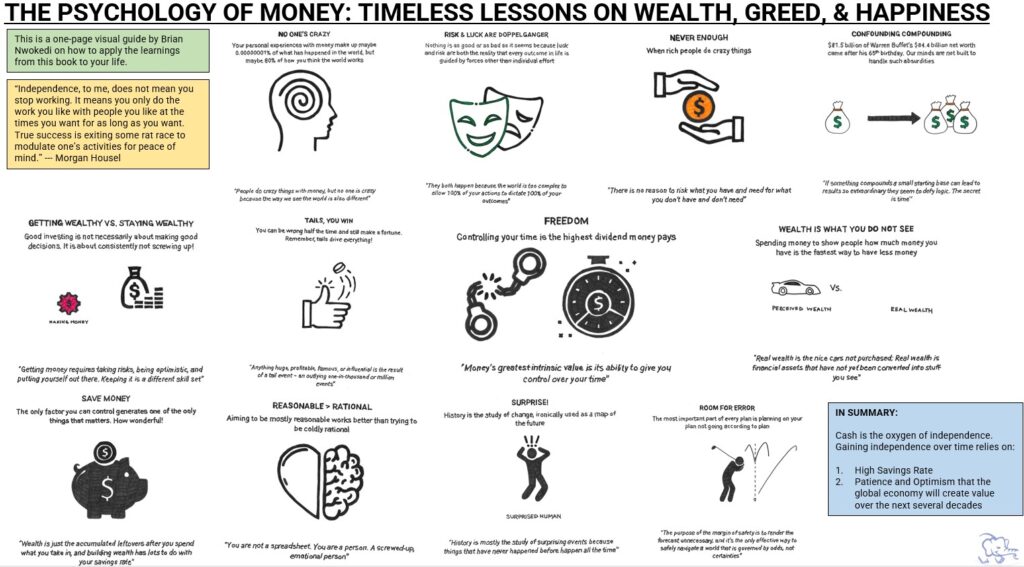

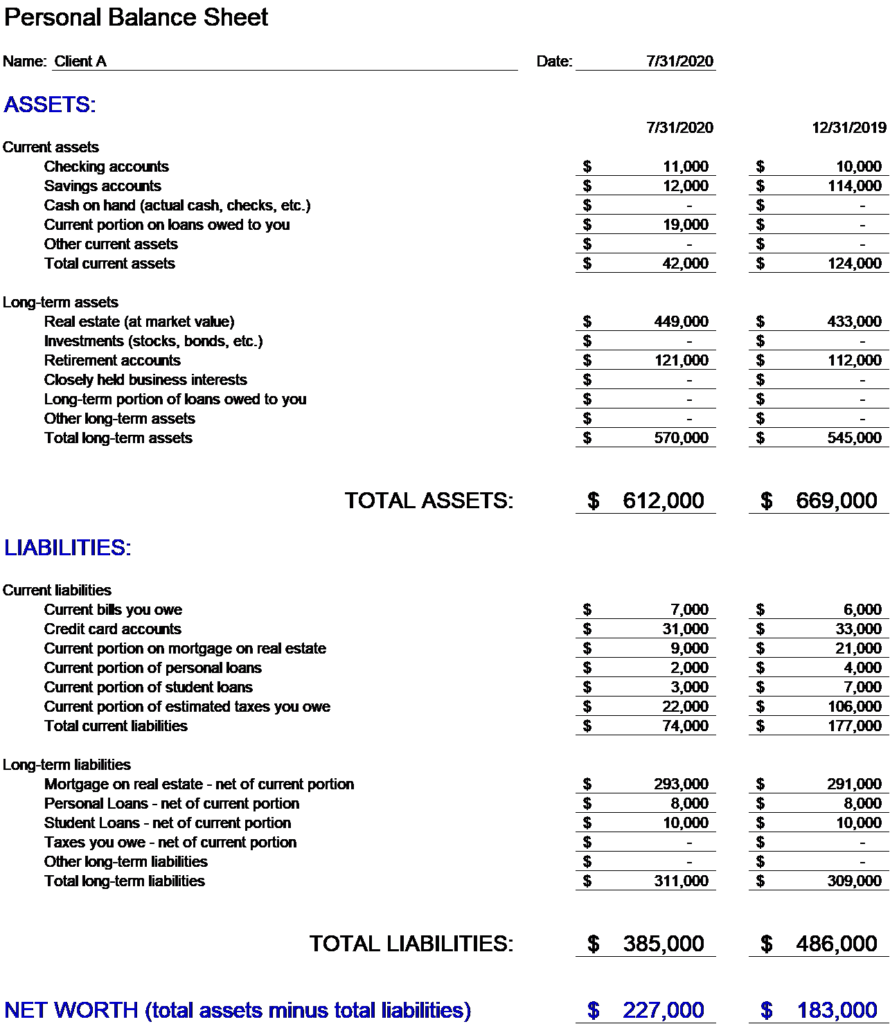

While it may be a hassle to create a financial plan, not knowing where you stand now makes it much harder to plan for where you need to be later in life, especially for retirement. At Blue Elephant Financial Services, we start our personal financial plan by taking a snapshot of your current Net Worth.

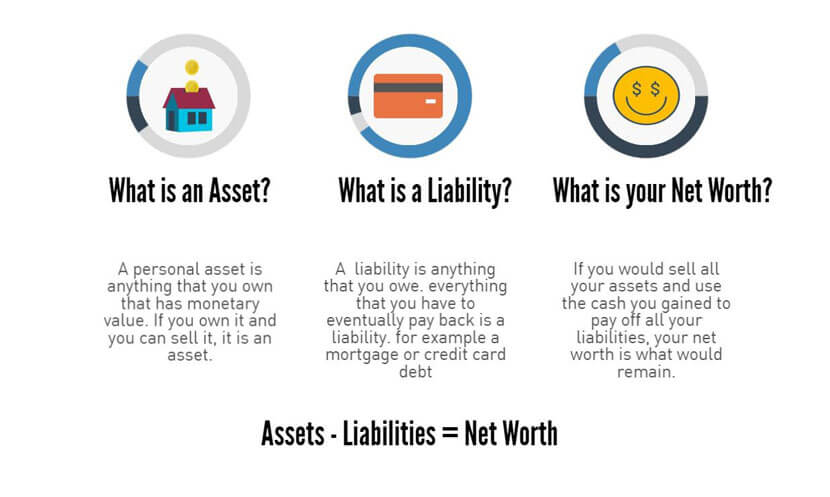

Your Net Worth is the sum of all of your Assets (i.e bank accounts, investments, car, home, etc.) minus your Liabilities or Outstanding Debts (i.e credit card debt, student loans, mortgage, car note, etc.)

The ultimate goal of the Blue Elephant Financial Services personal financial plan should be to drive towards increasing your Net Worth. The steps outlined below are my approach and strategy that will give you a sense of control, ultimately giving you the tools to drive towards financial stability:

1. Evaluate Your Spending Habits to see where we can trim expenses. The equation is relatively simple: Income – Expenses = Remainder. This remainder is positive when you spend less than you make. My job is to make you aware of how you spend your money, and work with you to cut out the “habitual & mindless” spending that ultimately hurts your long-term financial stability. Regardless of where your spending is, there is always an opportunity to trim and save/invest more.

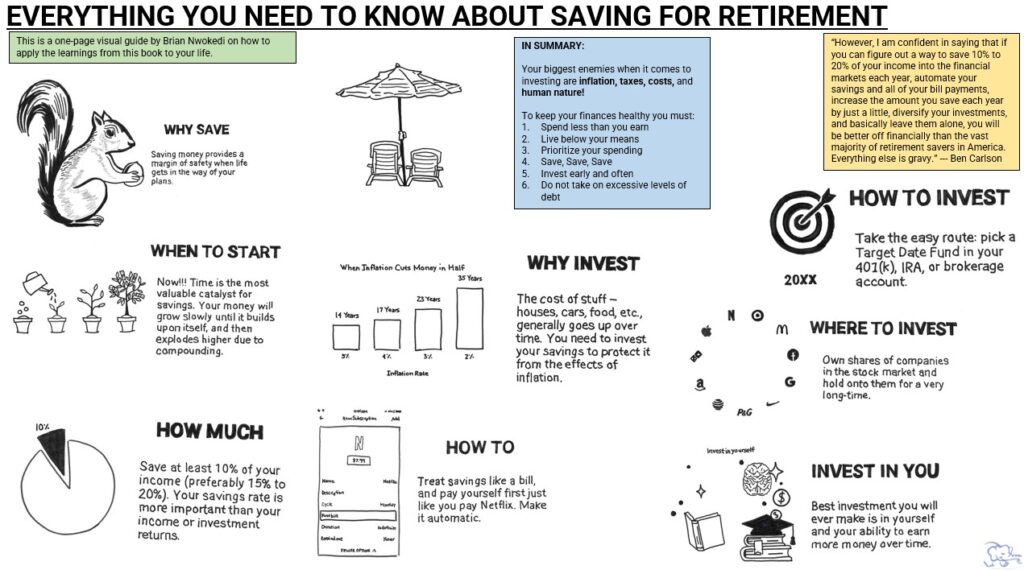

2. Build an Emergency Savings Account that can sustain 3 to 6 months of expenses. While other financial planners will tell you to pay down your debt first, it is my belief that a lack of emergency funds leads to a perpetual cycle of more debt in the long-term, especially when emergency expenses arise. I always suggest that each of my clients save a minimum of $1,000 before turning their attention to paying off debt. This builds cash which increases your Net Worth. We make sure to automate this by contributing a minimum of $25.00 a month to an online savings account such as Ally. Set it then forget it. This simple step will trick your brain into feeling self-motivated.

3. Pay off all High Interest Credit Card Debt. Any outstanding debt that is above 10% needs to be a primary focus of your financial plan. Paying off your credit will (+) increase your Net Worth, ultimately freeing up more of your funds to do other things with. Once you pay off your credit card debt, you will no longer be held back by principal, interest payments, and finance charges. This then frees up more of your funds to build your emergency savings and/or invest in your retirement account, which leads to better long-term growth in your Net Worth. On an aside, utilization rate of your credit card should never go above 30%.

4. If applicable, you should Pay of Any Outstanding car notes, student loans, and other non-mortgage debts with interest rates below 10%. Once you have eliminated your high interest credit card debt, you will now have a decision to make. I always suggest that extra funds should go towards paying off outstanding non-mortgage debt. The sooner you can get out of debt, the better off your future returns will be, ultimately driving significant gains in your Net Worth.

5. Once you have eliminated mindless spending, built an emergency fund, paid off high interest debt, and eliminated other outstanding non-mortgage debt, you are ready to Rapidly Ramp Up Your Retirement Savings. Your goal should be to save enough money so that you can live at 50% -70% of your current income. If your employer has a matching 401 (k), you should contribute enough from day one to get the match. Keep your investment allocation simple by picking a blended index fund as your retirement vehicle.

Blue Elephant is here to tailor your financial plan to meet your needs. Our plans always focus our efforts on maximizing your Net Worth which helps you ultimately meet your current and ongoing financial obligations.